Beautiful Info About Form 1065 Excel Template

Sign in to your account.

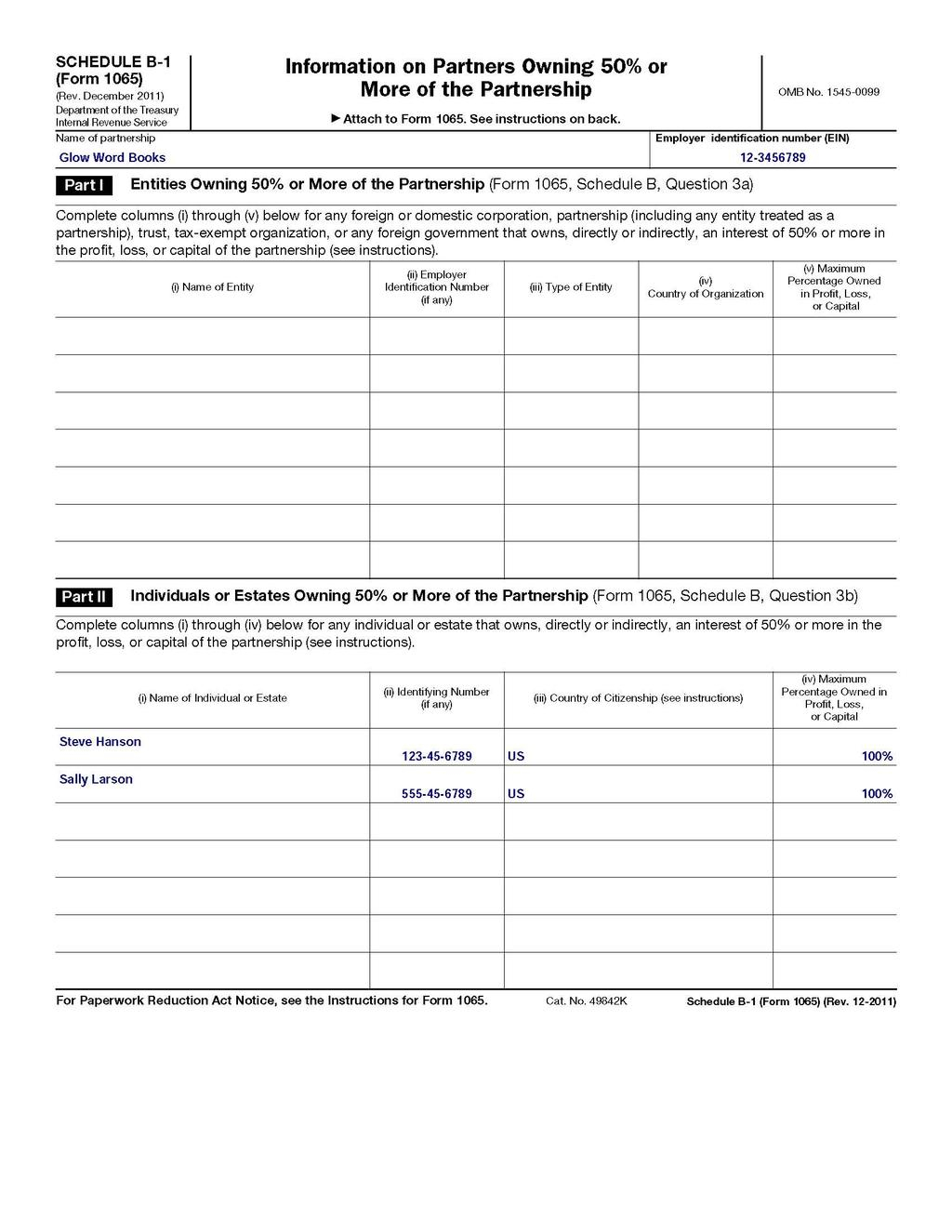

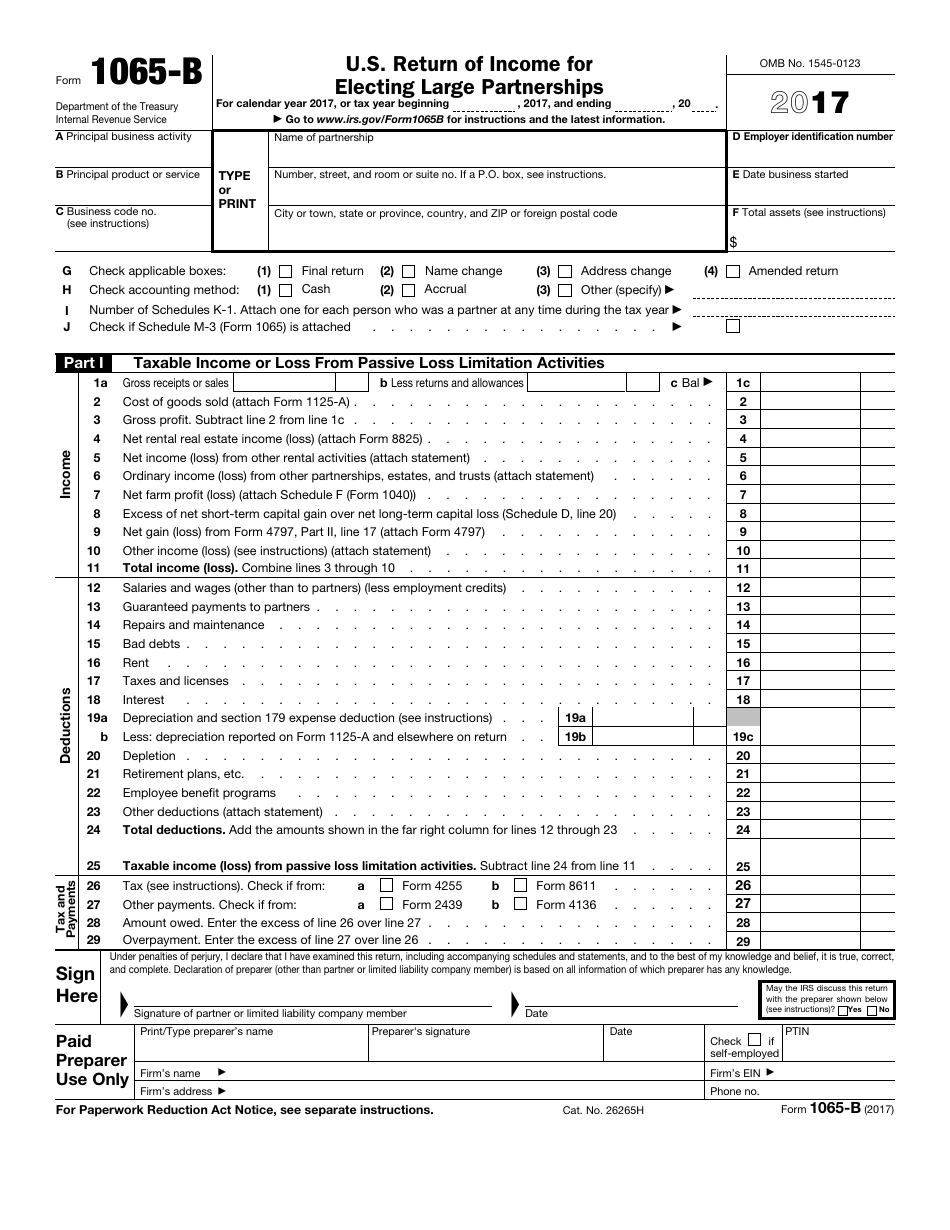

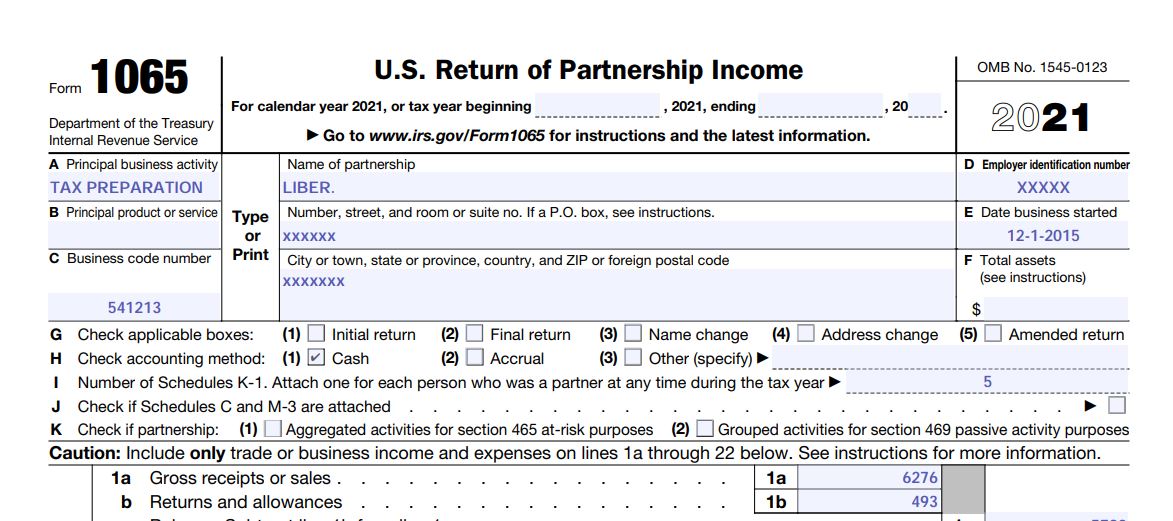

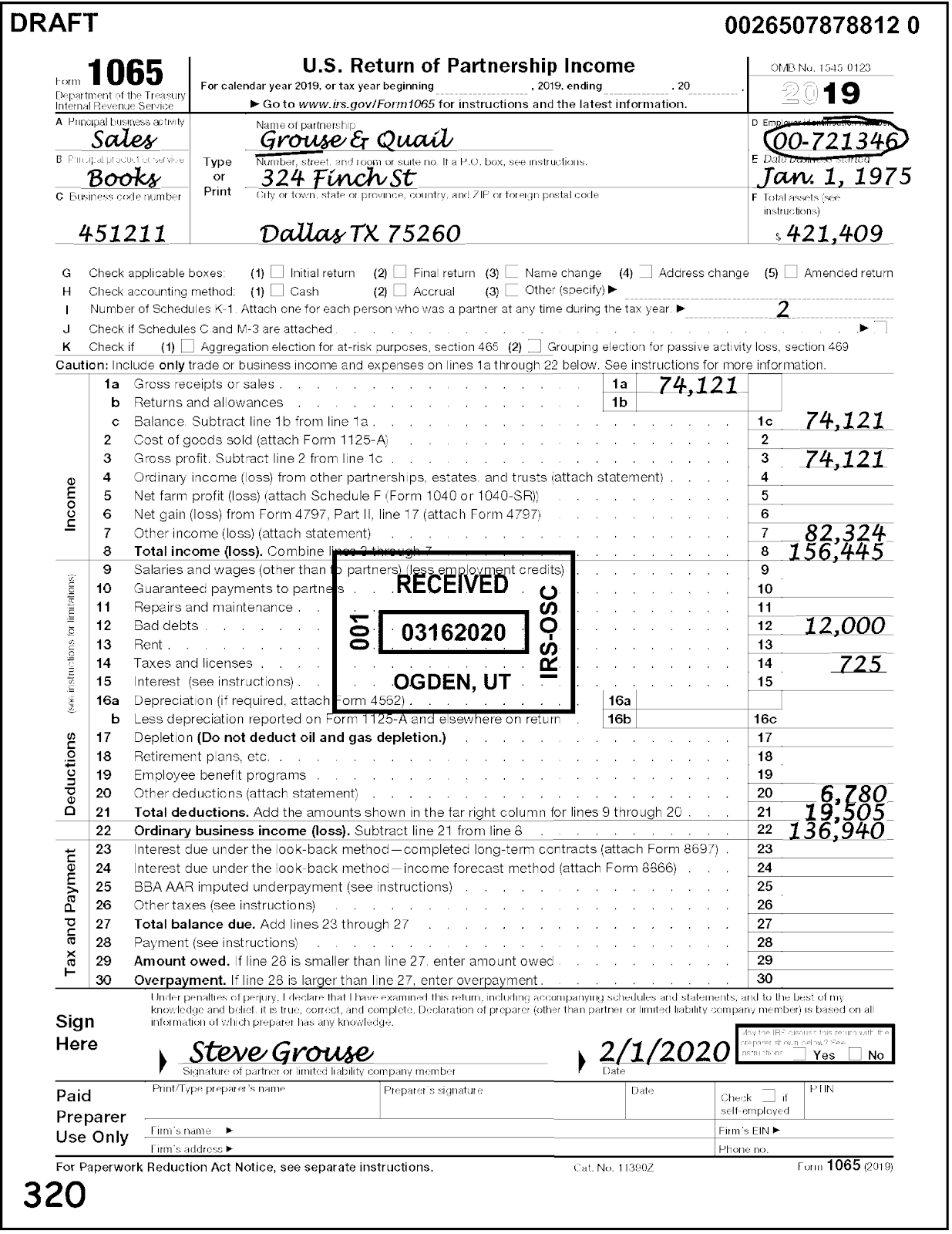

Form 1065 excel template. Gleen reeves' excel1040 let's start with one of the most comprehensive calculators. Here you would be transferred into a dashboard making it possible for you to make. Developments related to form 1065 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form1065.

Start at the top of the form, and enter the. Form 1065 excel template. Sign up with your email and password or register a free.

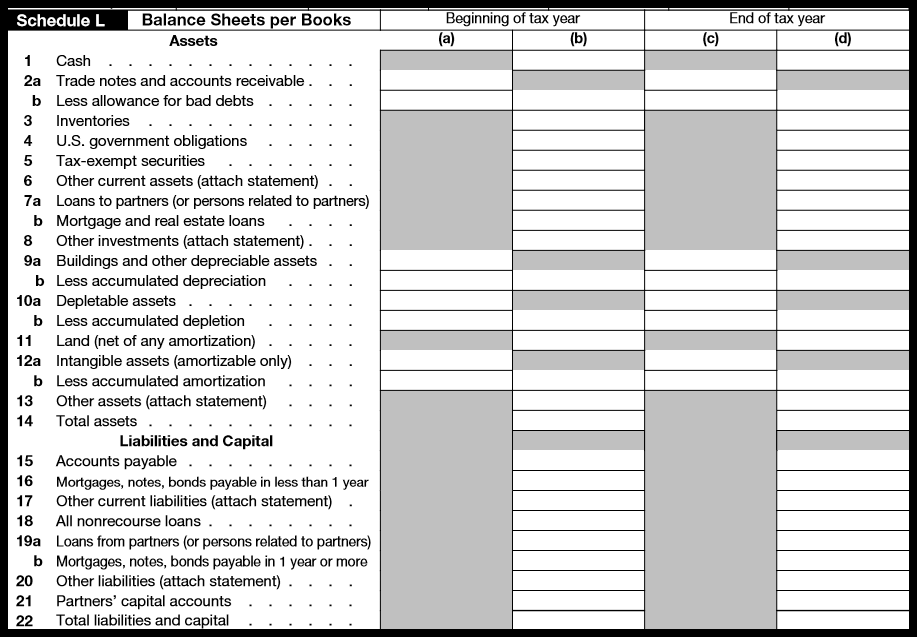

Open the excel template of form 1065 on your computer. The partnership tax return organizer should be used with the preparation of form 1065, u.s. If you are a first time client to nw tax &.

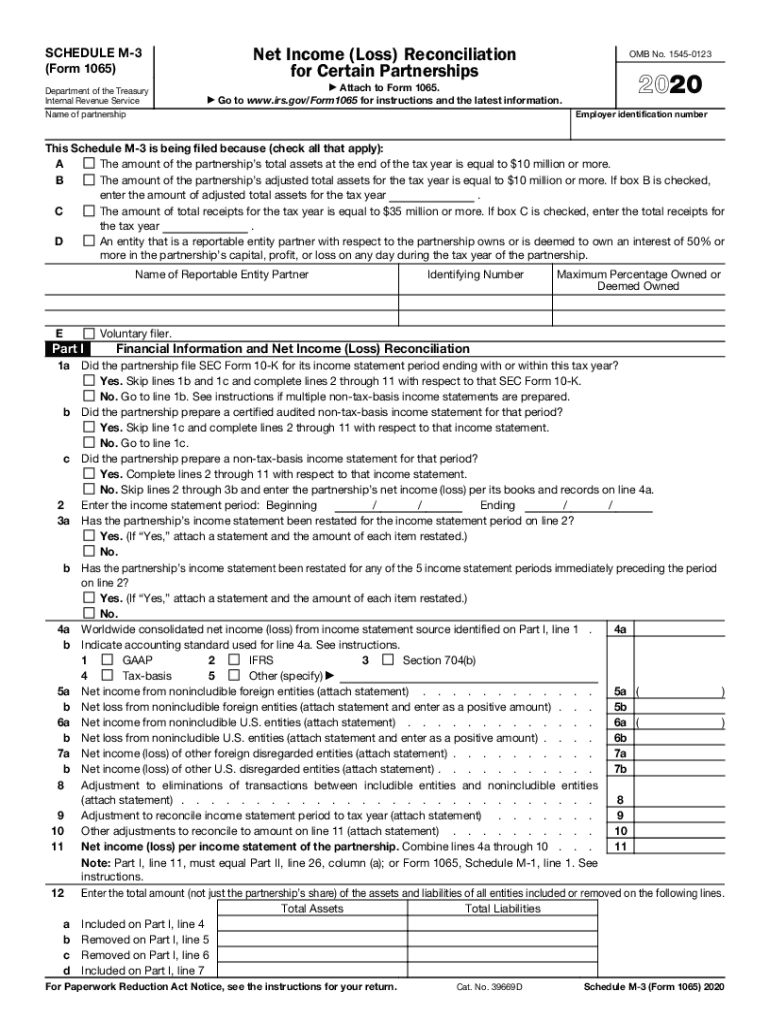

Go to www.irs.gov/form1065 for instructions and the latest information. A foreign partnership filing form 1065 solely to make an election (such as an election to amortize organization expenses) need only provide its name, address, and ein on page. To fill out form 1065 using an excel template, follow these steps:

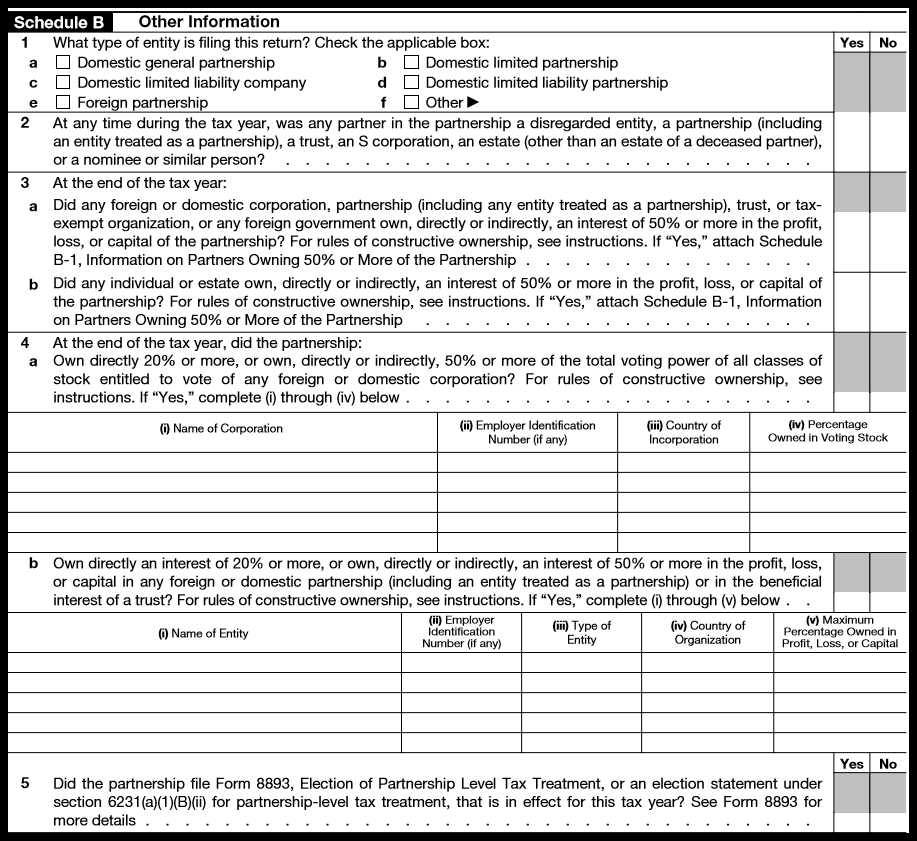

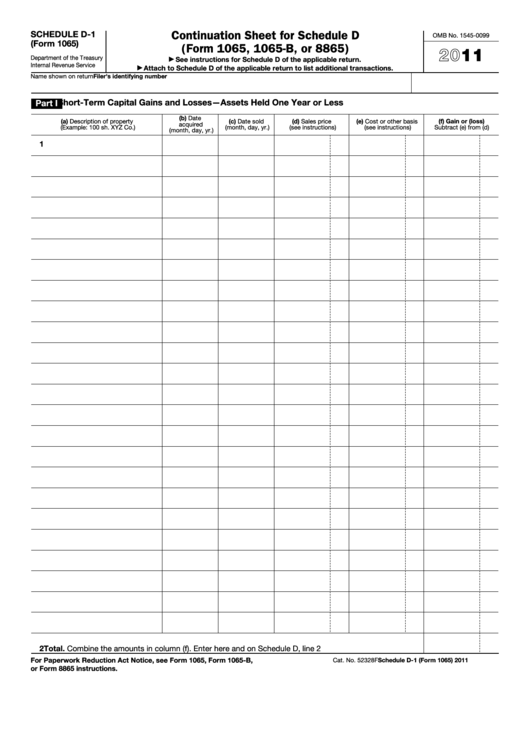

Form 1120 (2017) page 4 schedule k other information (continued from page 3) yes no 5 at the end of the tax year, did the corporation: This organizer is provided to help you gather and organize information that will be needed in the preparation of your partnership tax returns. Follow the instructions below to complete form 1065 excel template online easily and quickly:

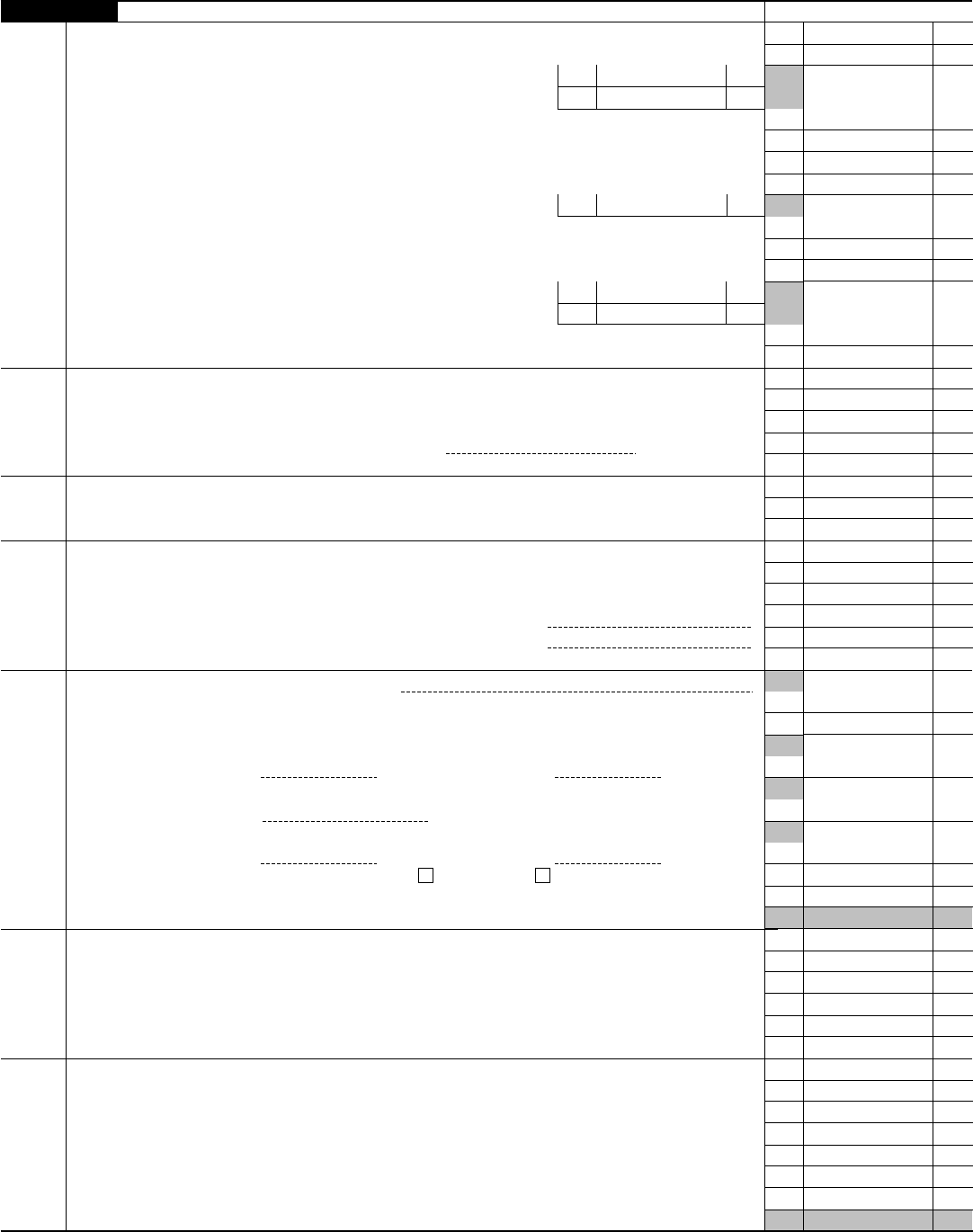

A useful guide to editing the form 1065 excel template push the“get form” button below. From the operation of a partnership or limited liability company (llc). Form 1065 is an informational return used to report the income, deductions, gains, losses, etc.

Provide it to your client to get started with tax planning. Information about form 1065, u.s. Tax calculator creator glenn reeves has been updating and distributing his.

Airslate’s preconfigured template enables you to , transforming the filling out of the form into a flexible,. A own directly 20% or more, or own,. Return of partnership income, including recent updates, related forms and instructions on how to file.

![How to Prepare Form 1065 in 8 Steps [+ Free Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/02/word-image-743.png)