Painstaking Lessons Of Info About Depreciation Policy Template

The objective of ias 16 is to prescribe the accounting treatment for property, plant, and equipment.

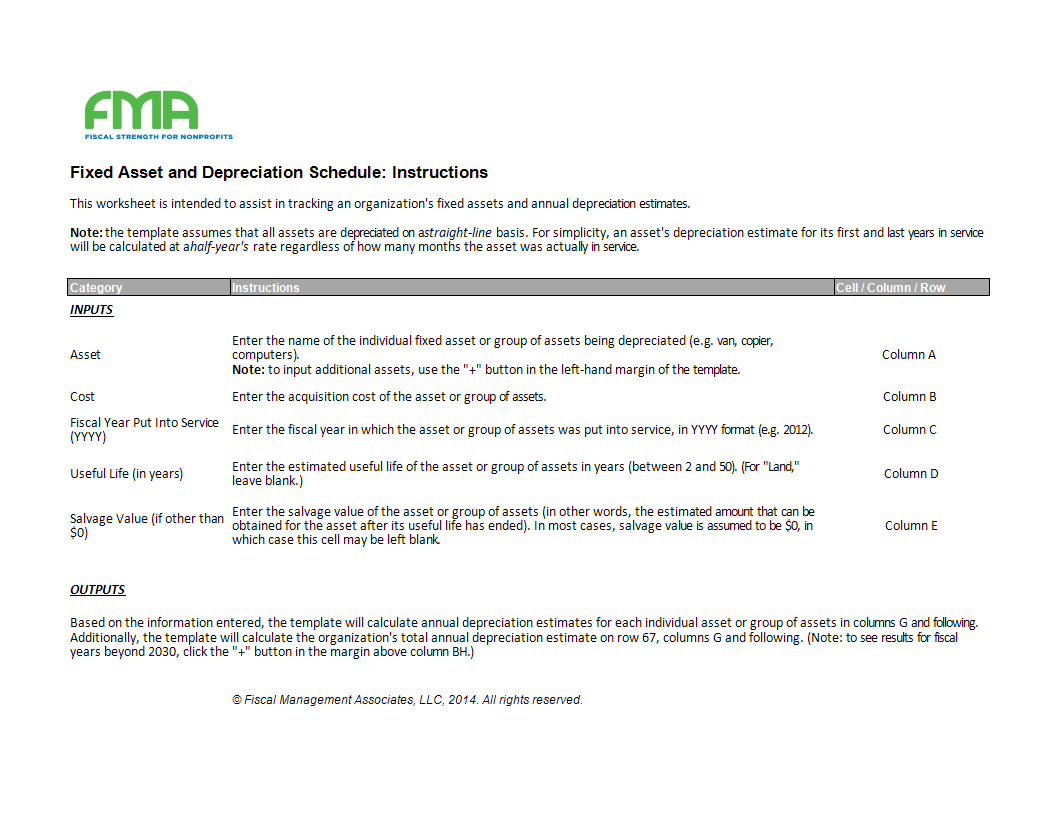

Depreciation policy template. Depreciation allows a business to allocate the cost of a tangible asset over its useful life for accounting and tax purposes. 06/01/2010 purpose to provide a systematic method that allows for the accurate. This depreciation methods template will show you the calculation of depreciation expenses using four types of commonly used depreciation.

The principal issues are the recognition of assets, the determination of their. Depreciation is the systematic reduction in the recorded cost of a fixed asset. Depreciation policy prepared by:

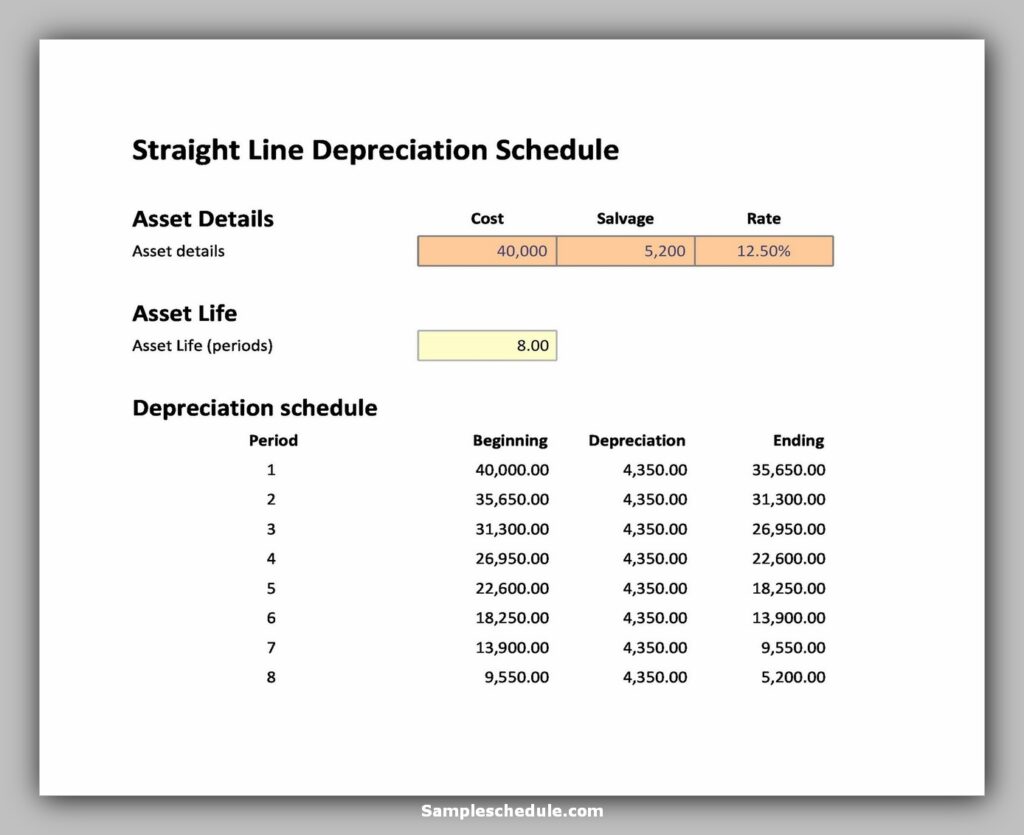

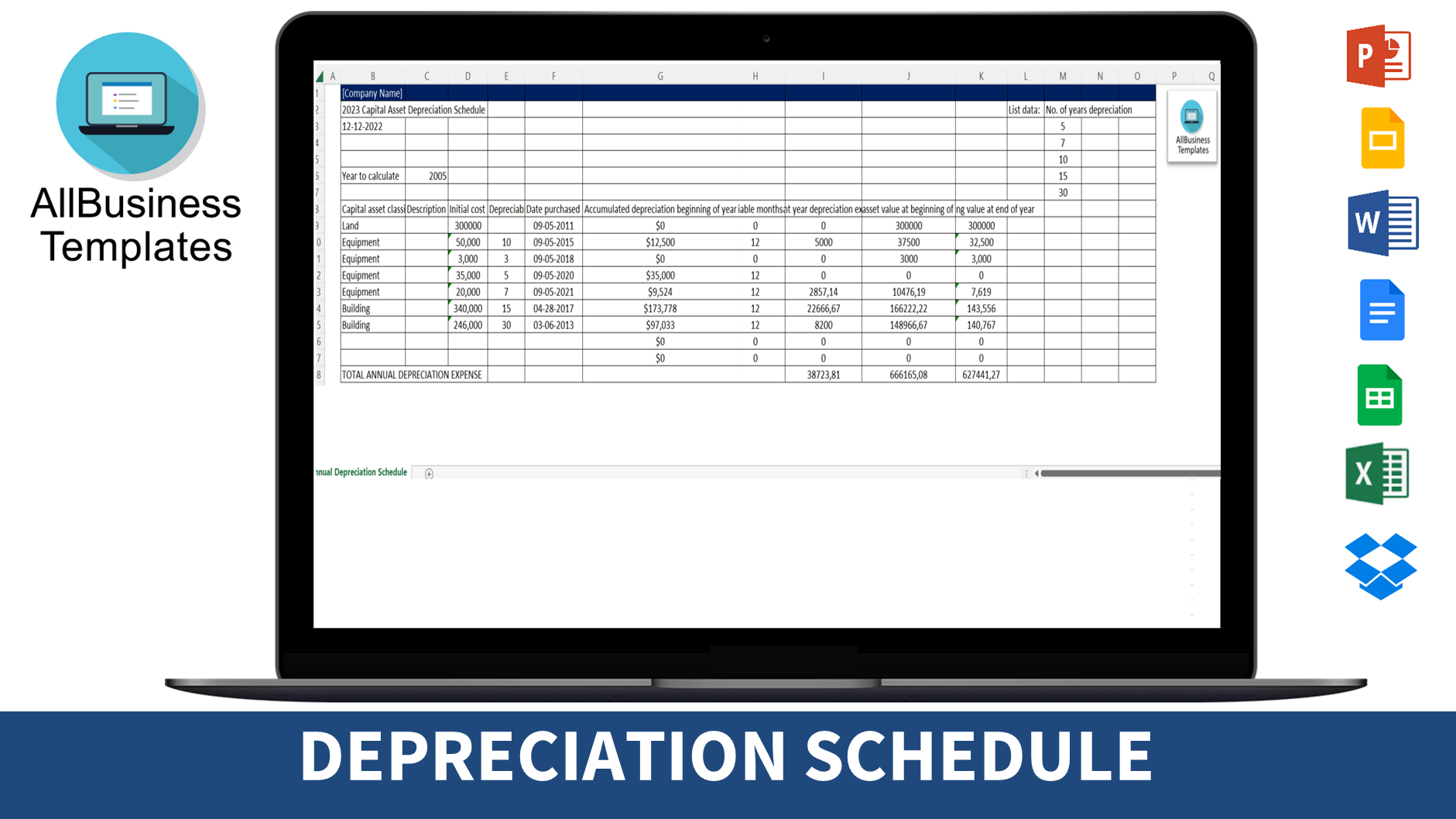

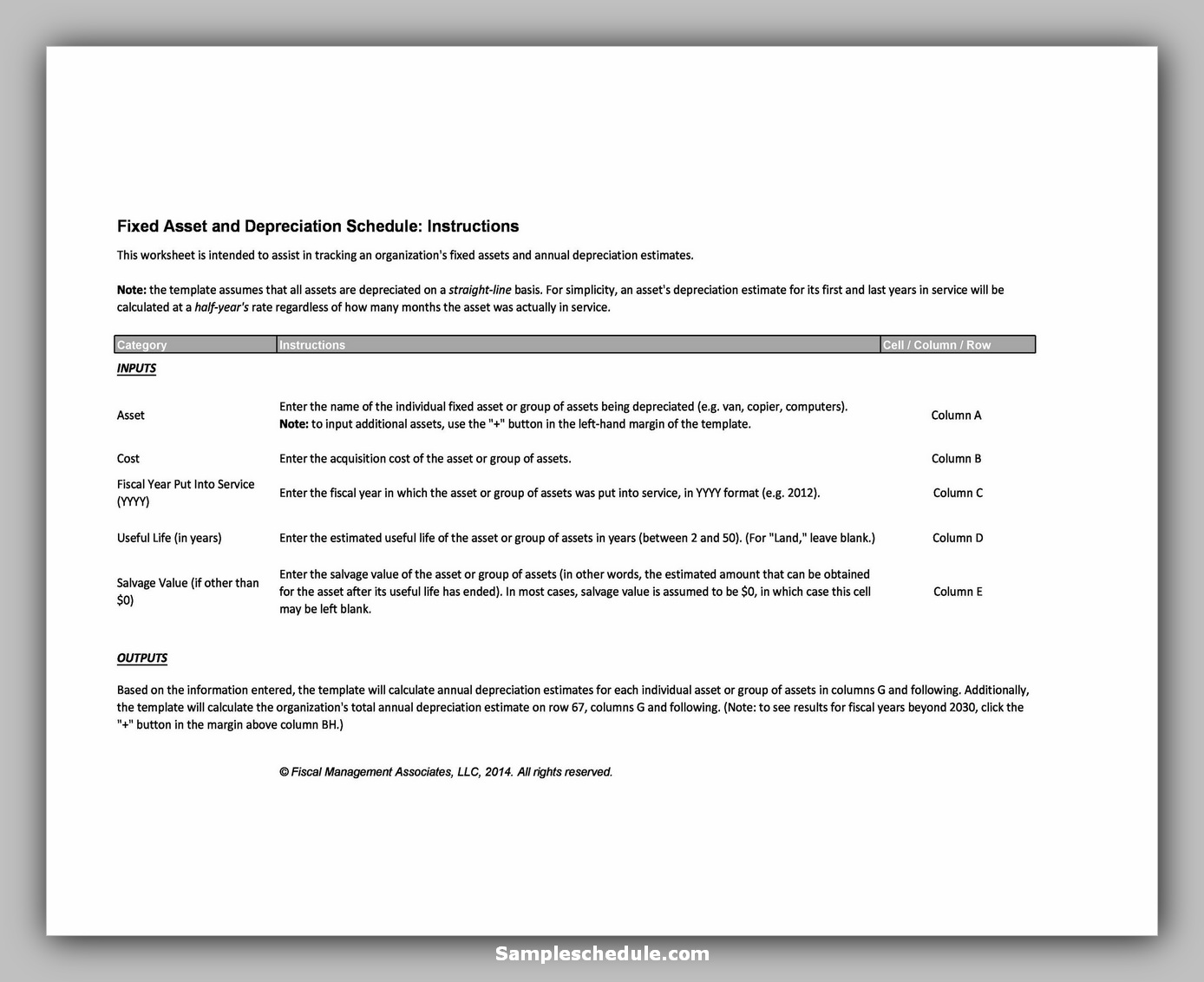

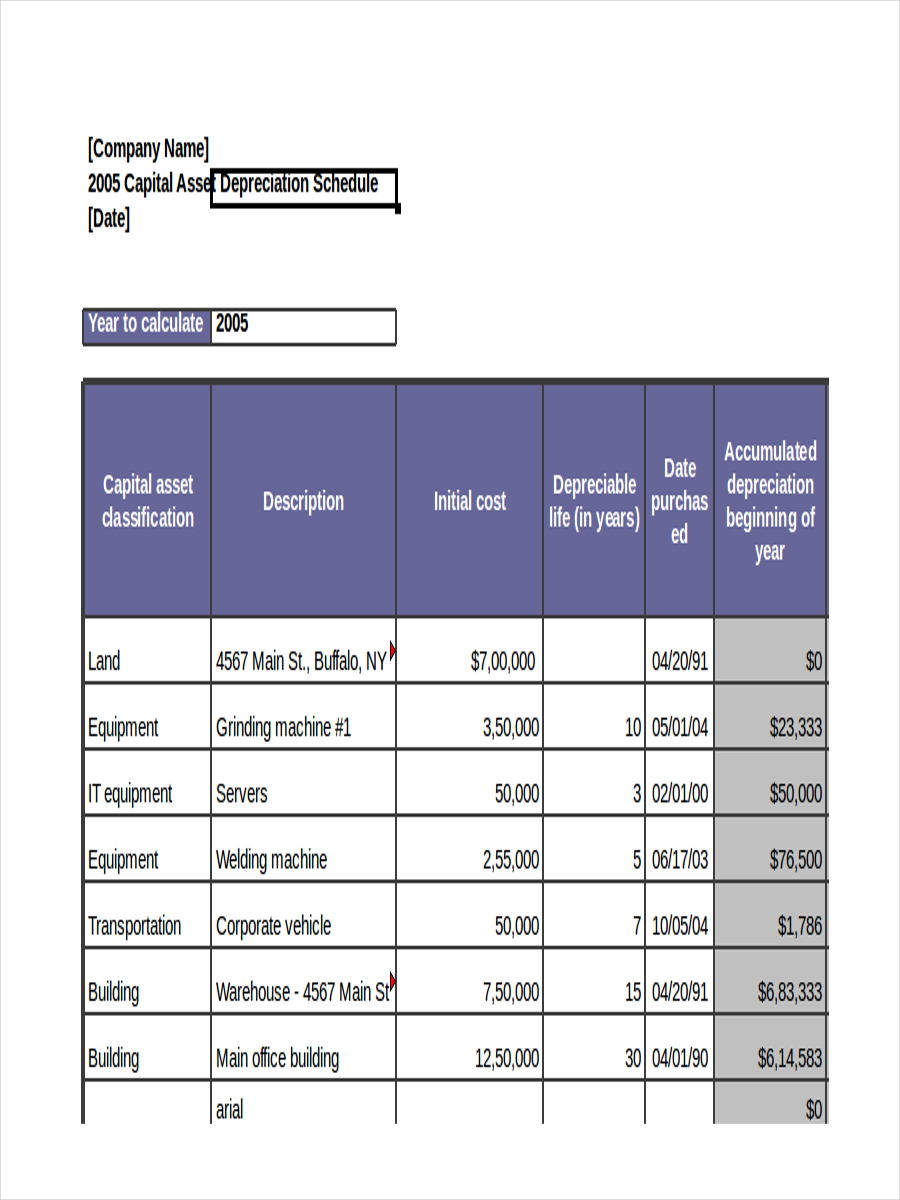

Businesses and organizations use a depreciation schedule template, a spreadsheet or document, to monitor and control the asset’s depreciation over time. Here are the different depreciation. Depreciation depreciation is the process of allocating the cost of tangible property over a period of time, rather than deducting the cost as an expense in the year of acquisition.

The university of north carolina at pembroke depreciation. The cost of the equipment will include the purchase price,. (1) to select the appropriate method of depreciation:

The reason for using depreciation is to. In this task, you will determine the appropriate depreciation method for each fixed asset. Town of windham capital assets and depreciation policy:

Our small business edition provides an easy way to organize the. Determine the depreciation period of the asset. Purpose this accounting policy establishes the method of maintaining fixed asset information and the minimum cost (capitalization amount) that shall be used to determine.

Set the depreciation rate of the asset. The accounting policies and procedures templates are available for small, medium and larger enterprises. The only exception is land, which is not depreciated.

Examples are parking lots, sidewalks, fiber optics, etc. Depreciation is the process of allocating the cost of property over a period of time, rather than recognizing the cost as an expense in the year of acquisition. Depreciation reflects the reduction in value over time due to wear and tear,.

(2) to review of the current provision for depreciation whether there is any under provision for. Get access the capitalization and depreciation policy for your.

/GettyImages-1174783581-020e7504020947dc979f864f2ebee096.jpg)