Glory Info About Snowball Budget Excel

The debt snowball is a method for paying off your consumer debt (not your mortgage).

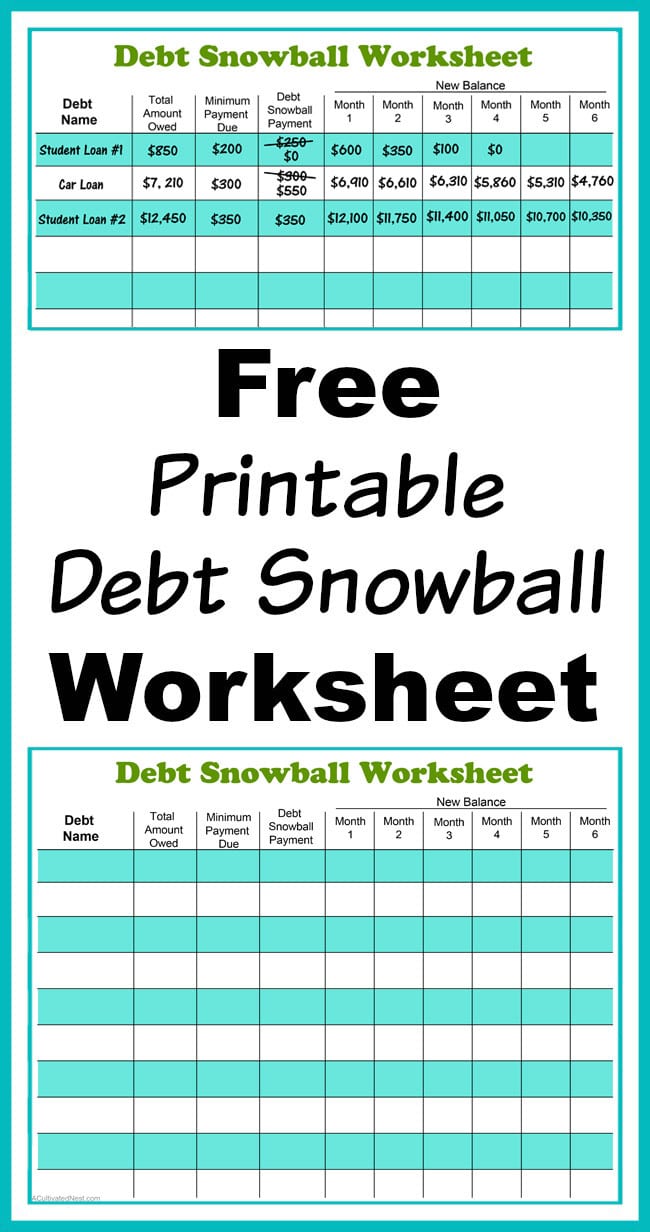

Snowball budget excel. To use this free printable. List your bills from smallest to largest. What is the debt snowball?

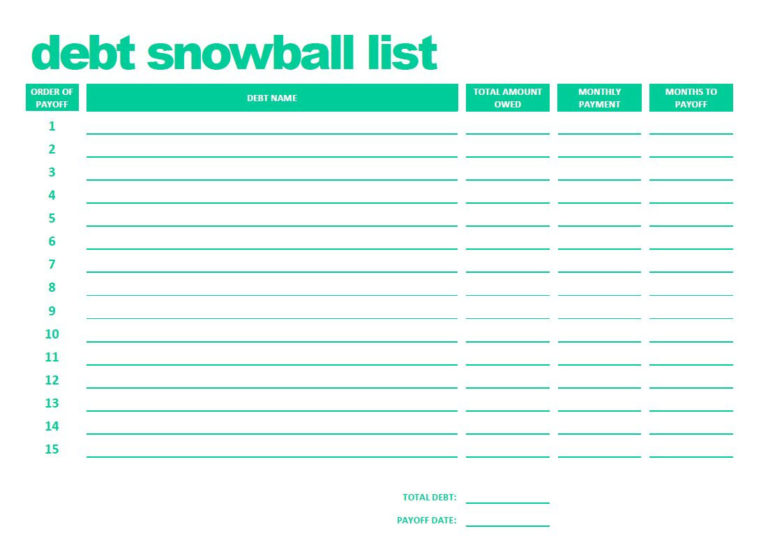

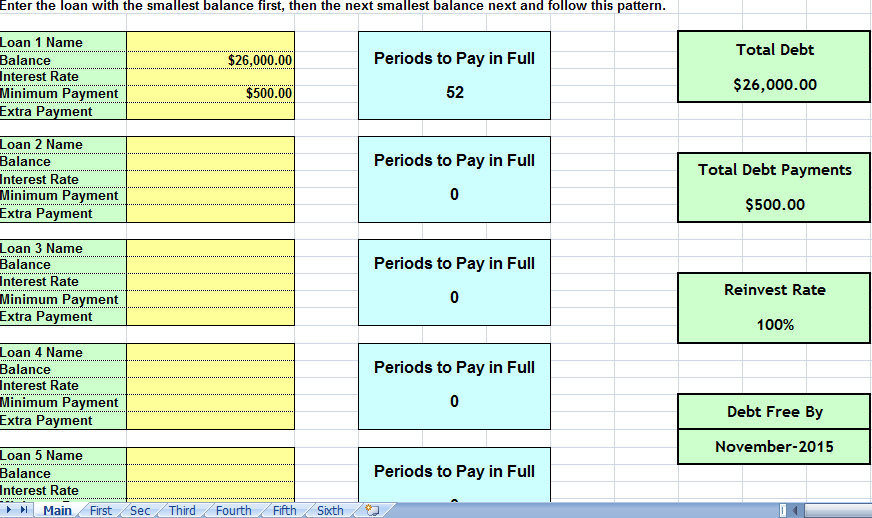

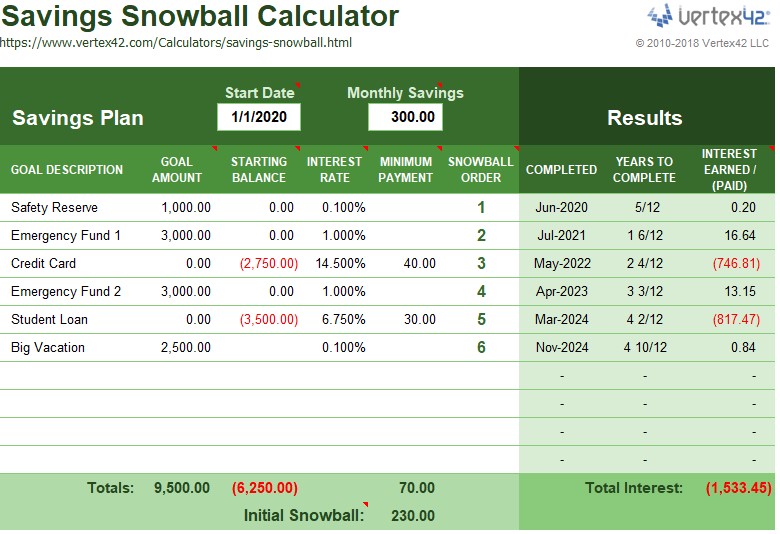

The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. In this method, you’ll use a debt snowball spreadsheet or a debt snowball form. 9+ debt snowball excel templates written by iamadmin in excel the snowball debt means to pay off one debt at time with all the cash you have until the cash is fully paid off.

Download and use debt snowball tracker free excel template. It contains tables for each date, including. You throw the snowball at your top.

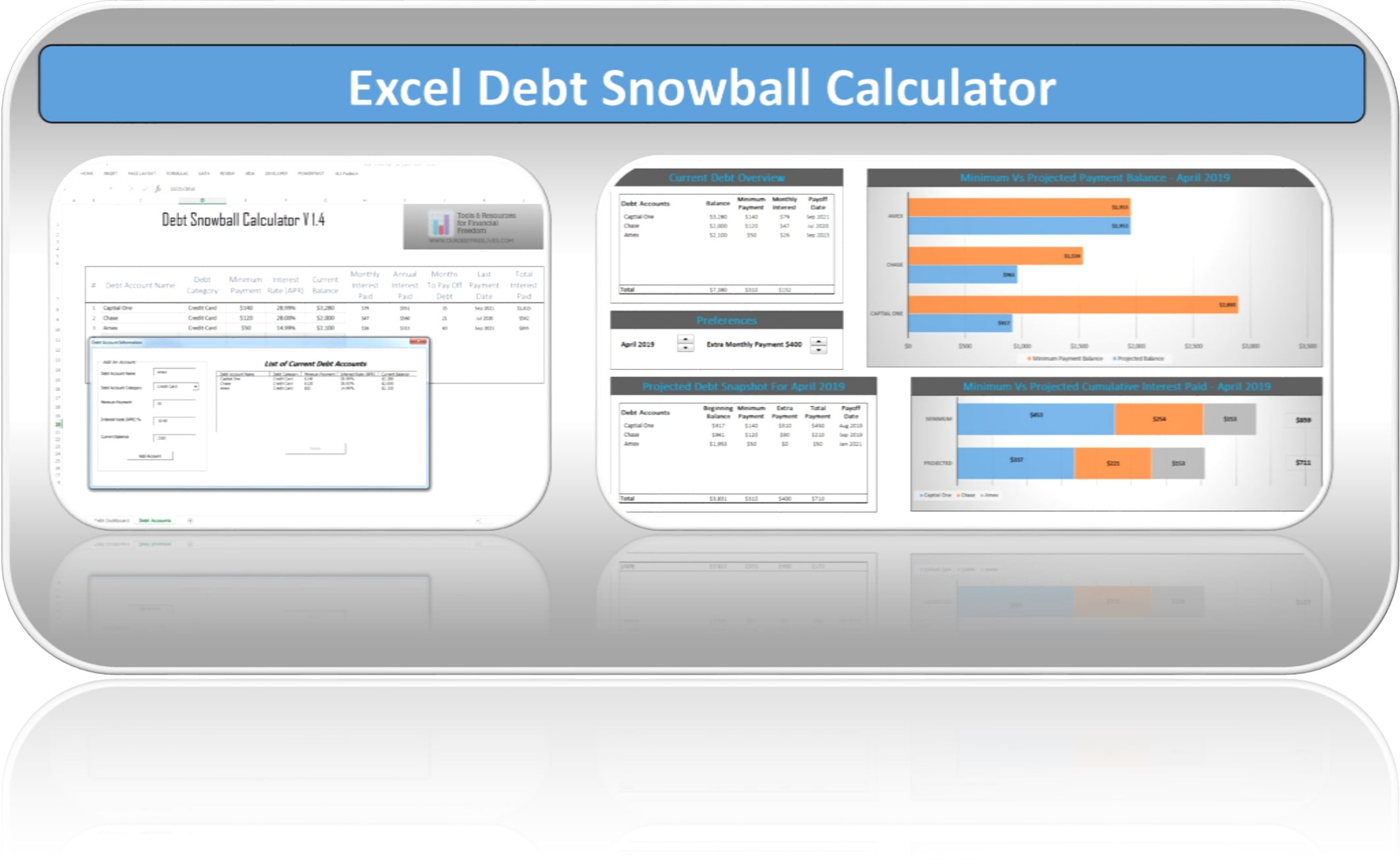

How does a debt snowball calculator excel work? The more you can squeeze out of your budget to increase your debt snowball, the faster you’ll reach. The snowball is the amount of budget savings left over after making minimum payments.

Instead of looking at the interest rate, you simply pay off the smallest debt. Debt snowball spreadsheets are extremely helpful in planning your debt freedom strategy. It will allow you to forecast.

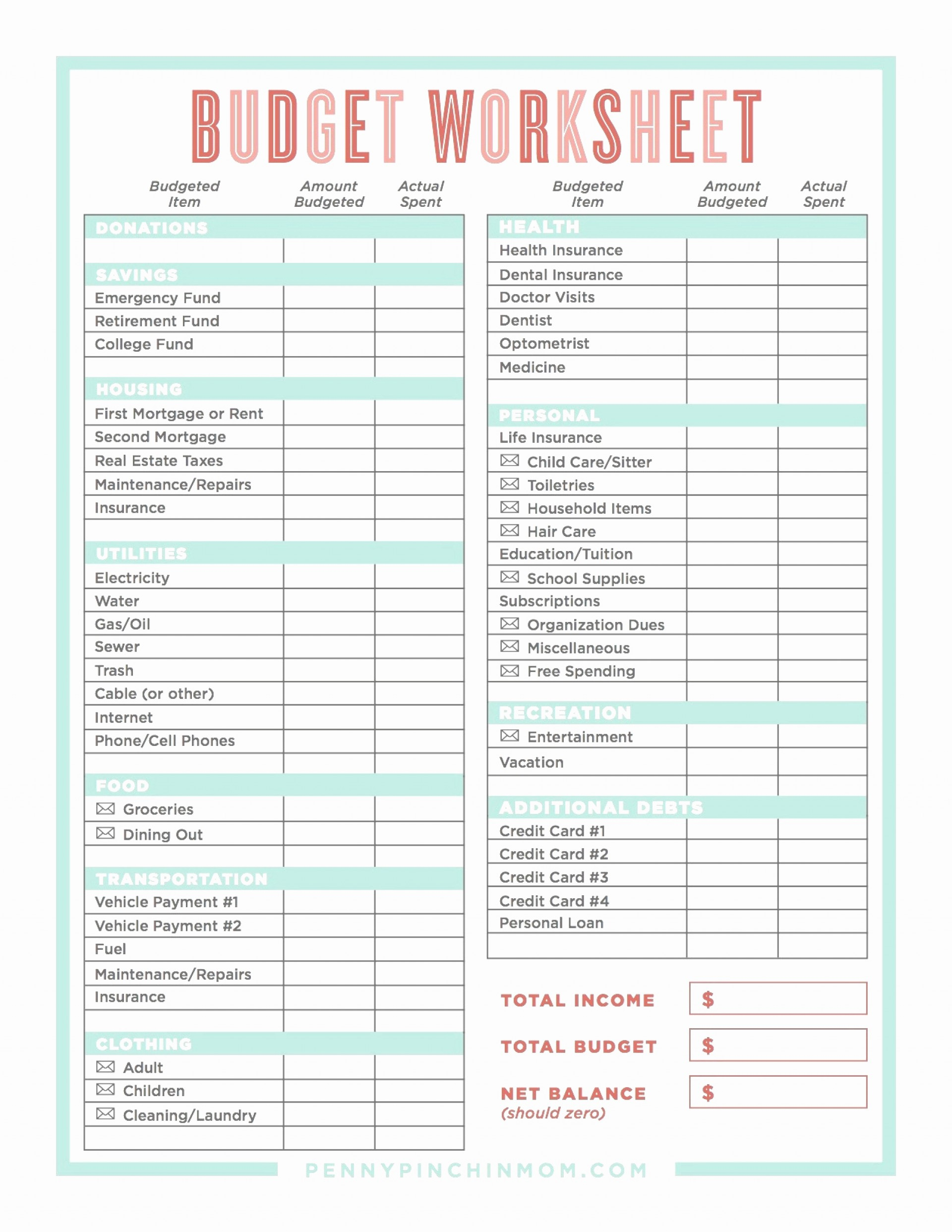

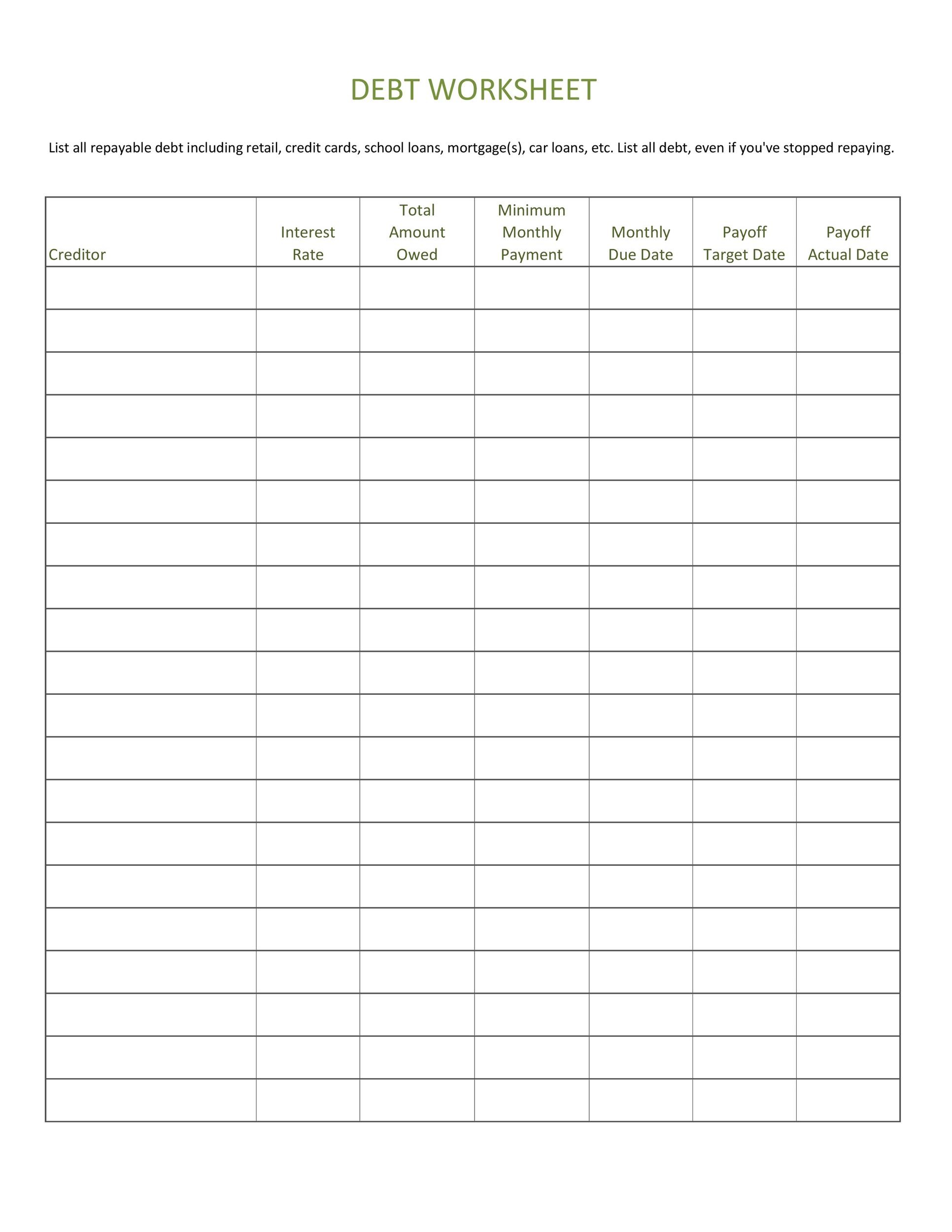

Follow these simple steps to use the debt snowball worksheet: They are designed to help you apply the 'pay god first' principle, the 'pay yourself first' principal,. Enter abbreviated names for your credit card or lending institution, the current balances, and the interest rate information for all of your current debts (including home equity lines of credit or second mortgages).

The boxes for the minimum payment and the extra snowball payment are just for reference. Business success stories 18 min read google sheets debt snowball spreadsheet: Get the easy budget debt snowball spreadsheet.

The first step in a debt snowball plan is to make a budget, then stick to it. One option on this list even. Snowball debt payoff spreadsheet excel will allow you to easily calculate and determine exactly how much you need to pay on which debt and when.

Make a list of all the debt you make payments toward each month. This shouldn’t be bills that you pay in their entirety, like. The categories in this worksheet have a very purposeful structure.