Can’t-Miss Takeaways Of Info About Backtesting Excel Template

It is vital to get good quality historical price data before backtesting.

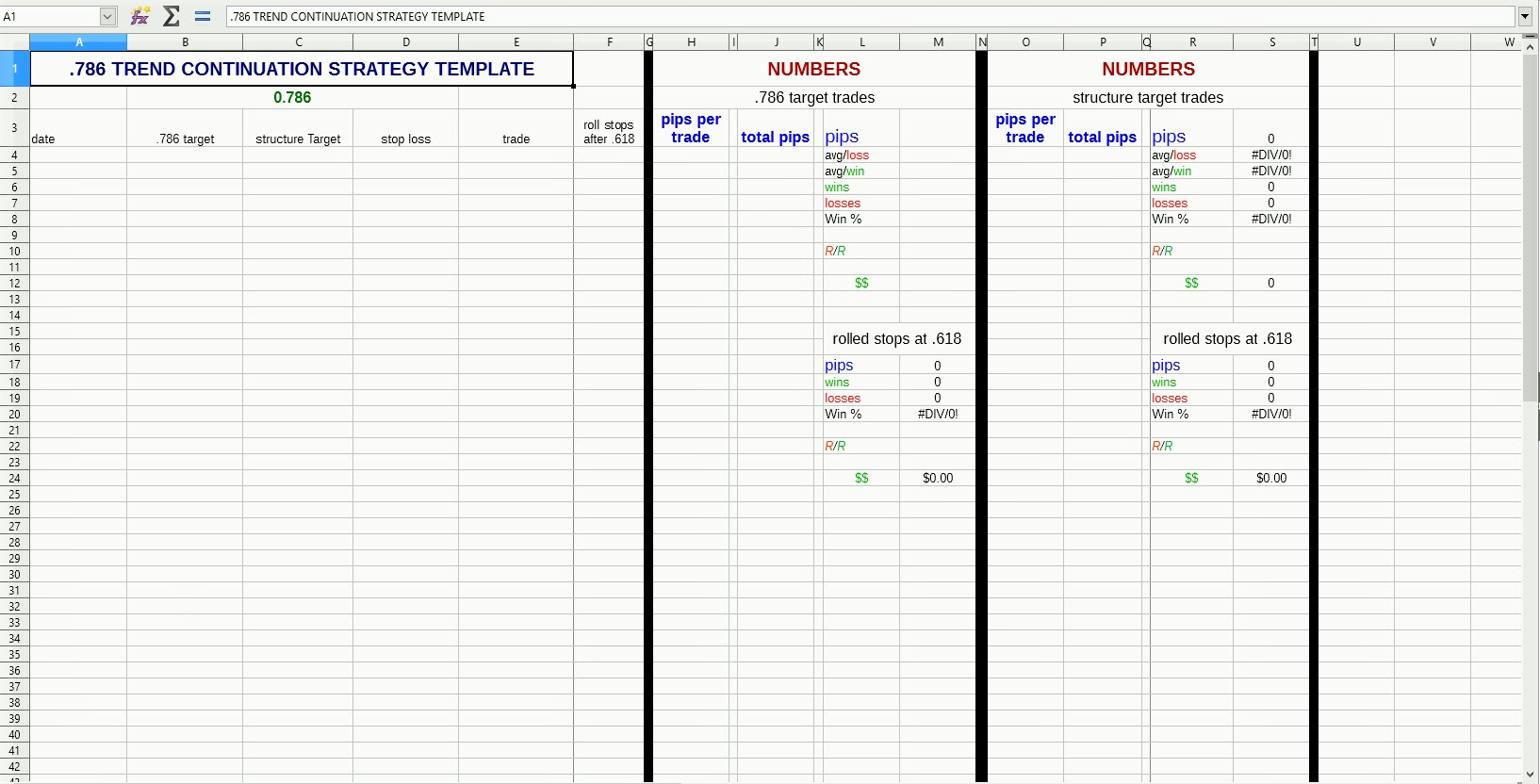

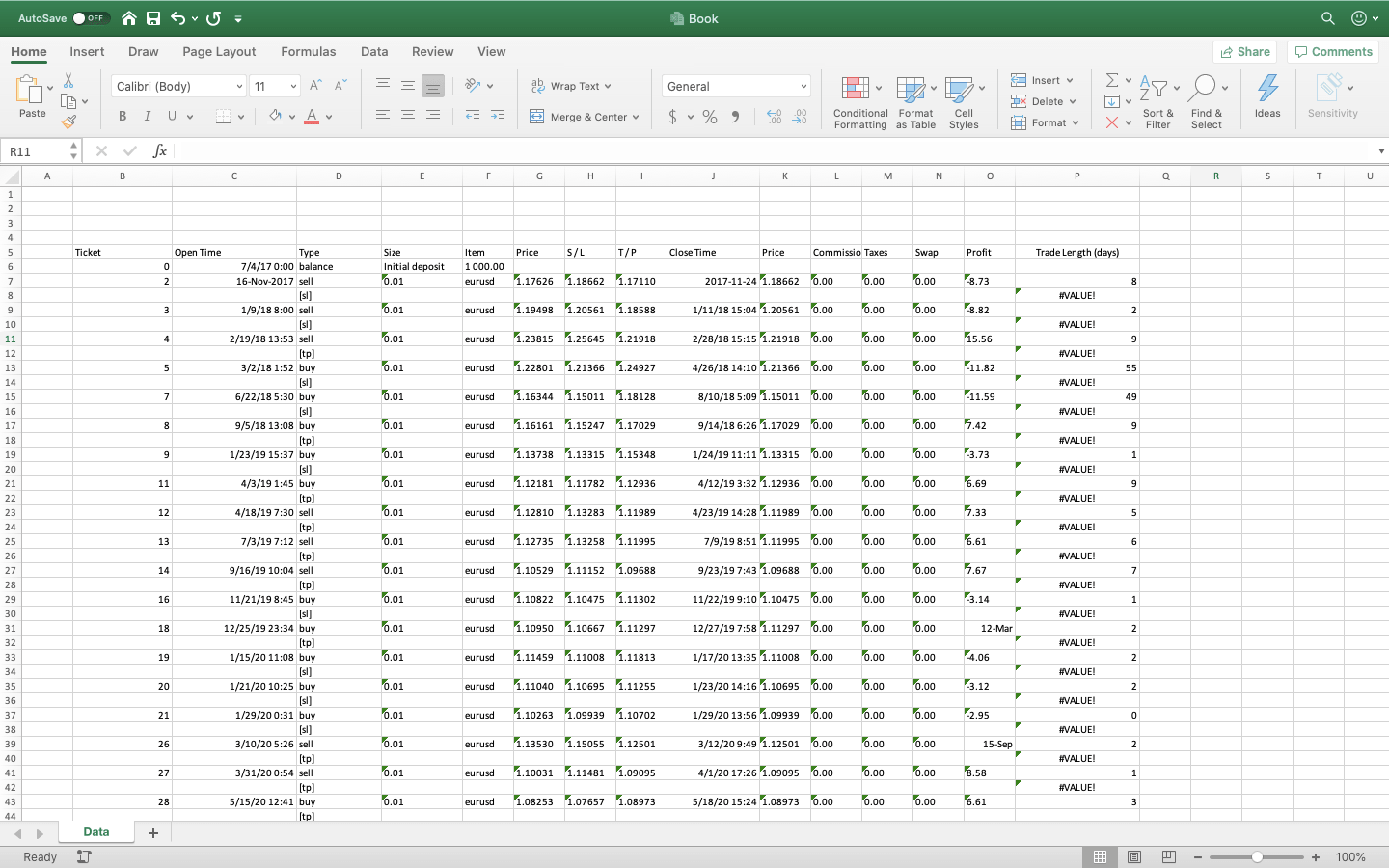

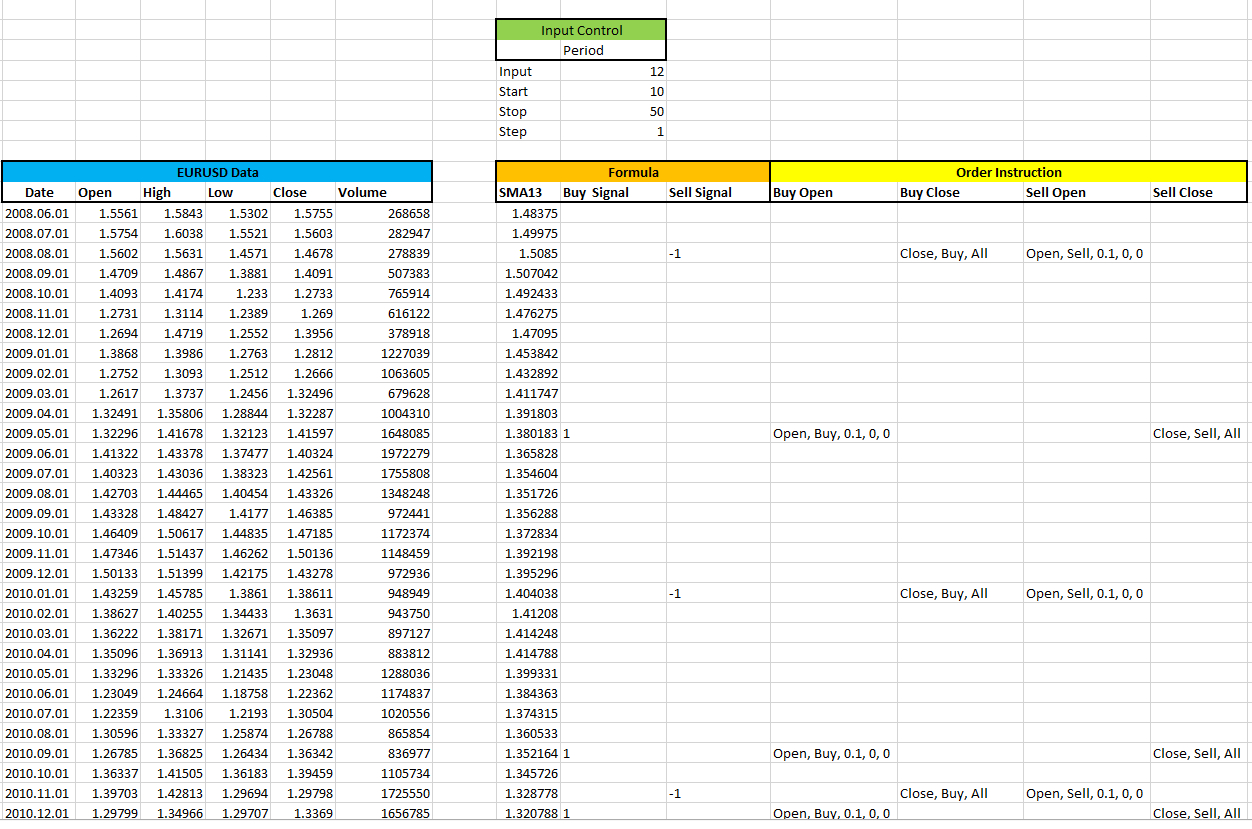

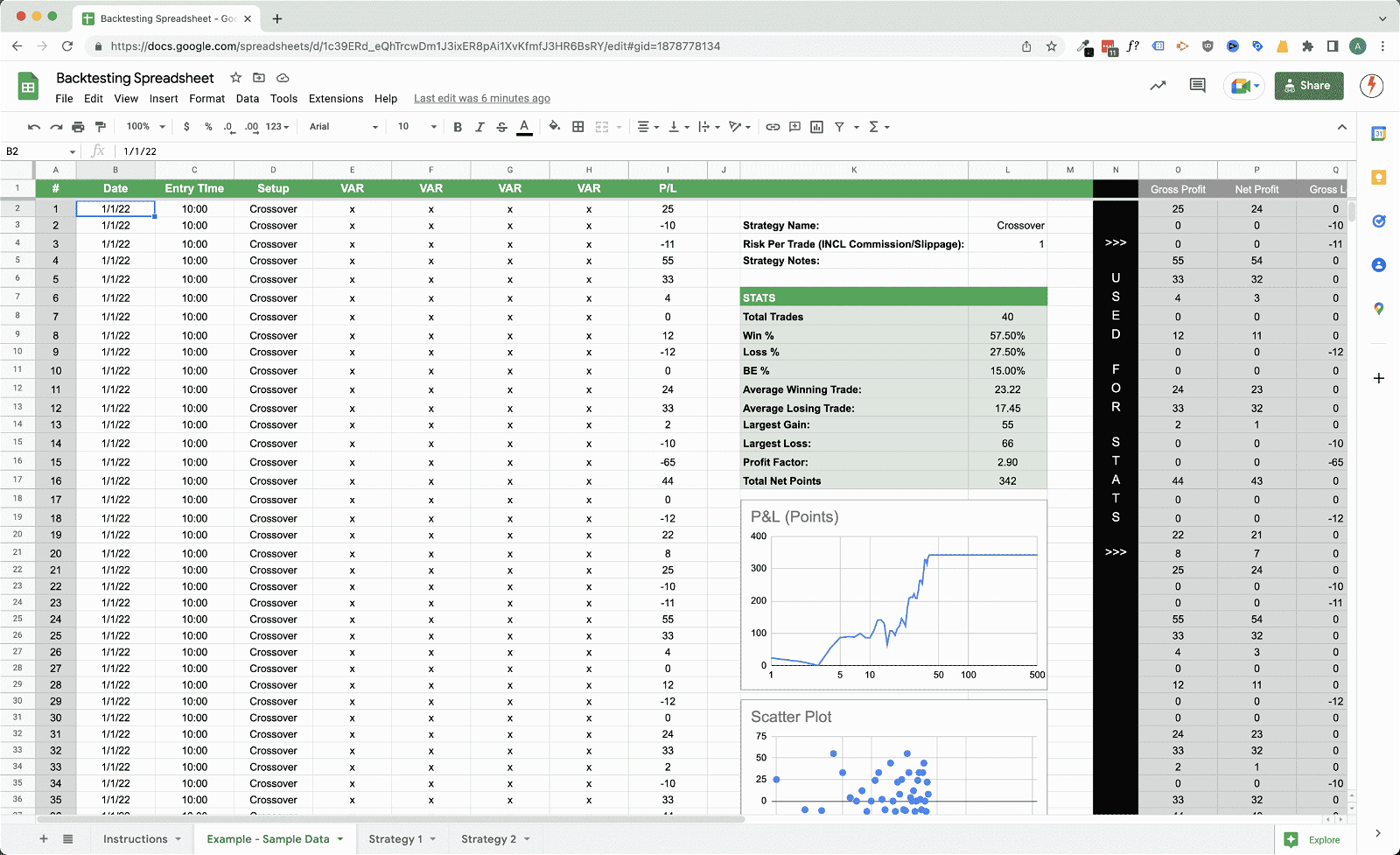

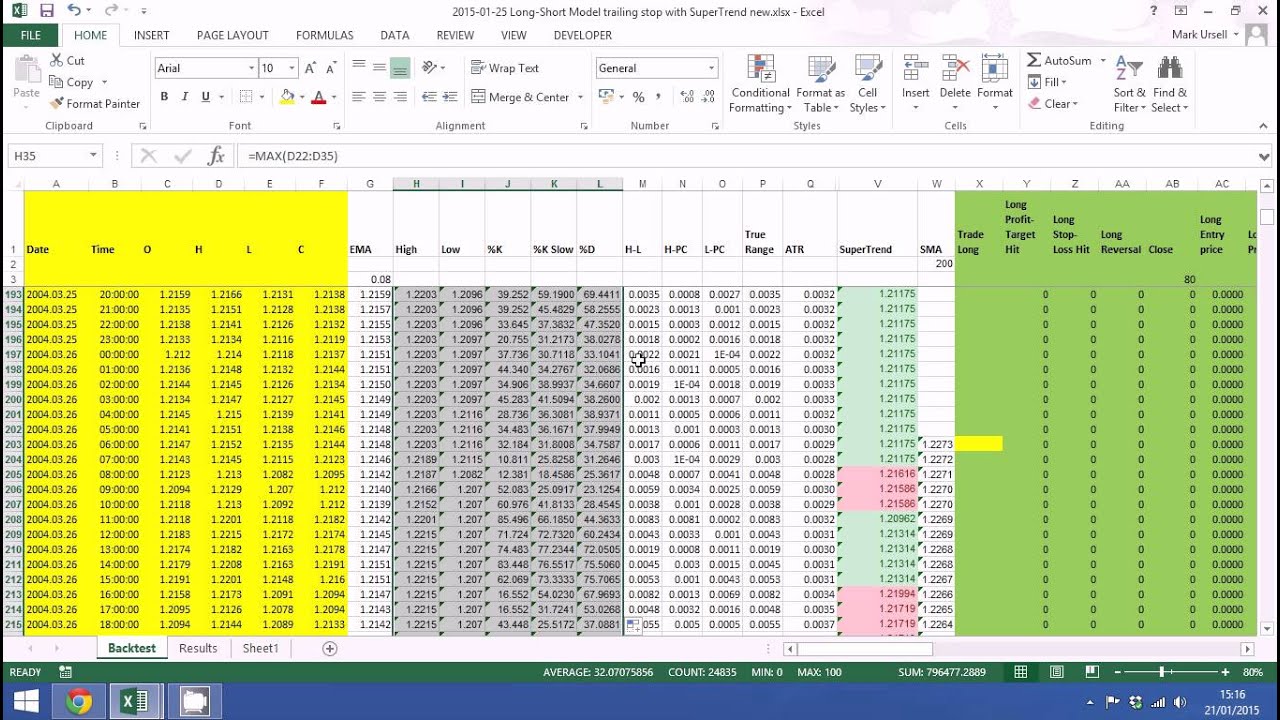

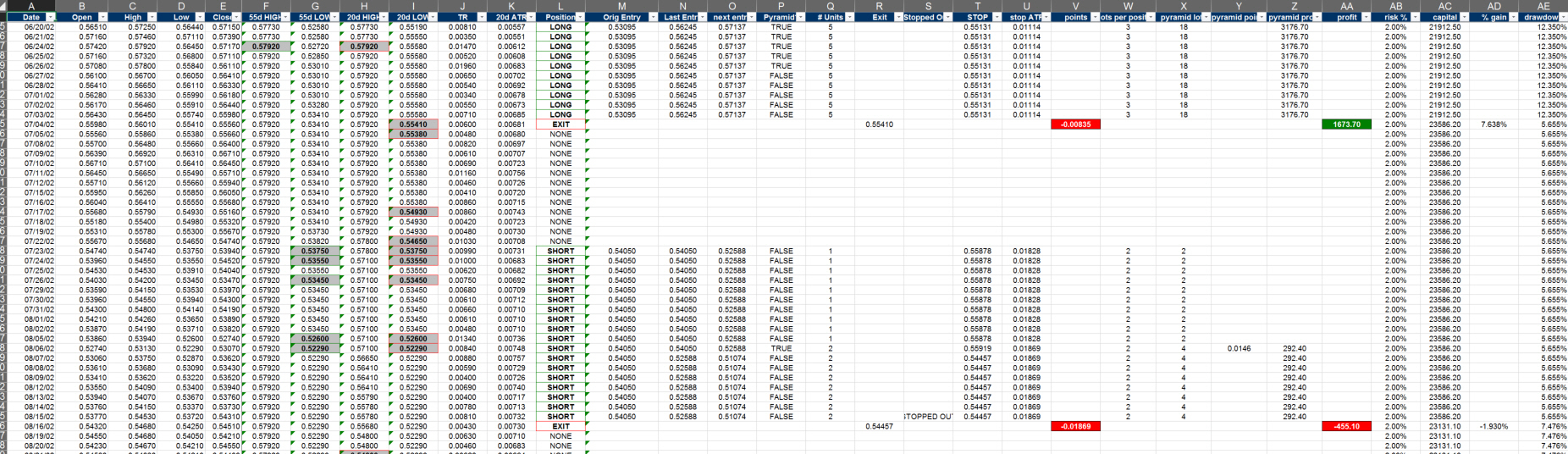

Backtesting excel template. The backtesting spreadsheet will help you see if your strategy makes sense or not, or just for an extended backtest to see if your strategy follows through momentum swings and keeps making profits regardless. Here’s how to test it in our simple spreadsheet. We need to get some data for the symbol that we are going to back test.

Many people seem to get overwhelmed a. Steps how to backtest a trading strategy in excel total time: Backtesting tutorial using relative strength index (rsi) and volatility risk premium as indicators.

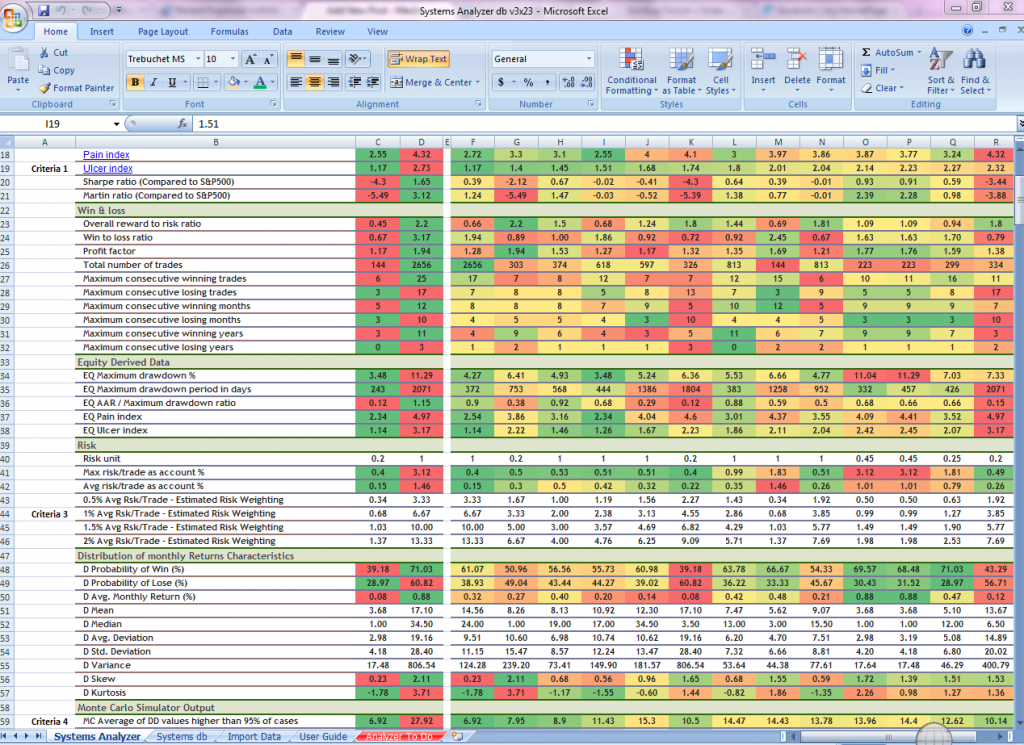

There are several ways to backtest an excel trading model. Introduction starting your first backtest can be a bit like trying to solve a puzzle blindfolded. How to gather them, what can be found in a backtesting report and what do they tell us and how we can calculate the information we’ve gathered.

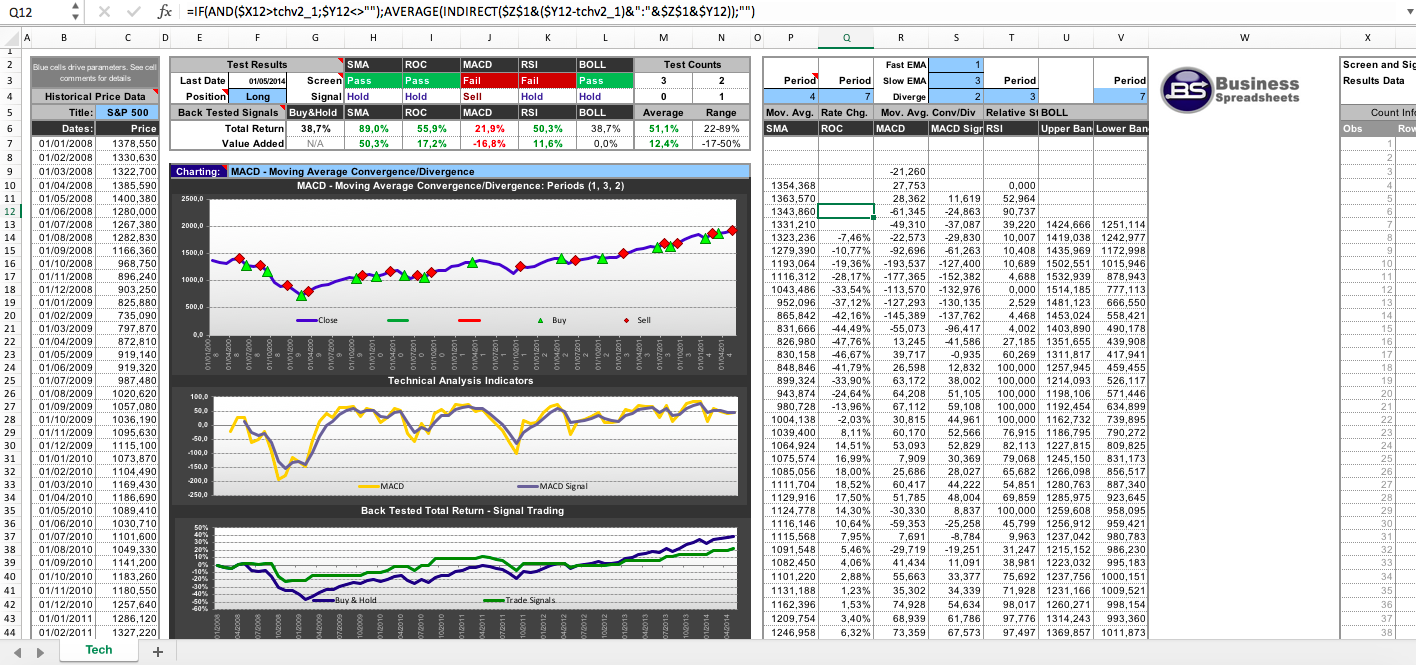

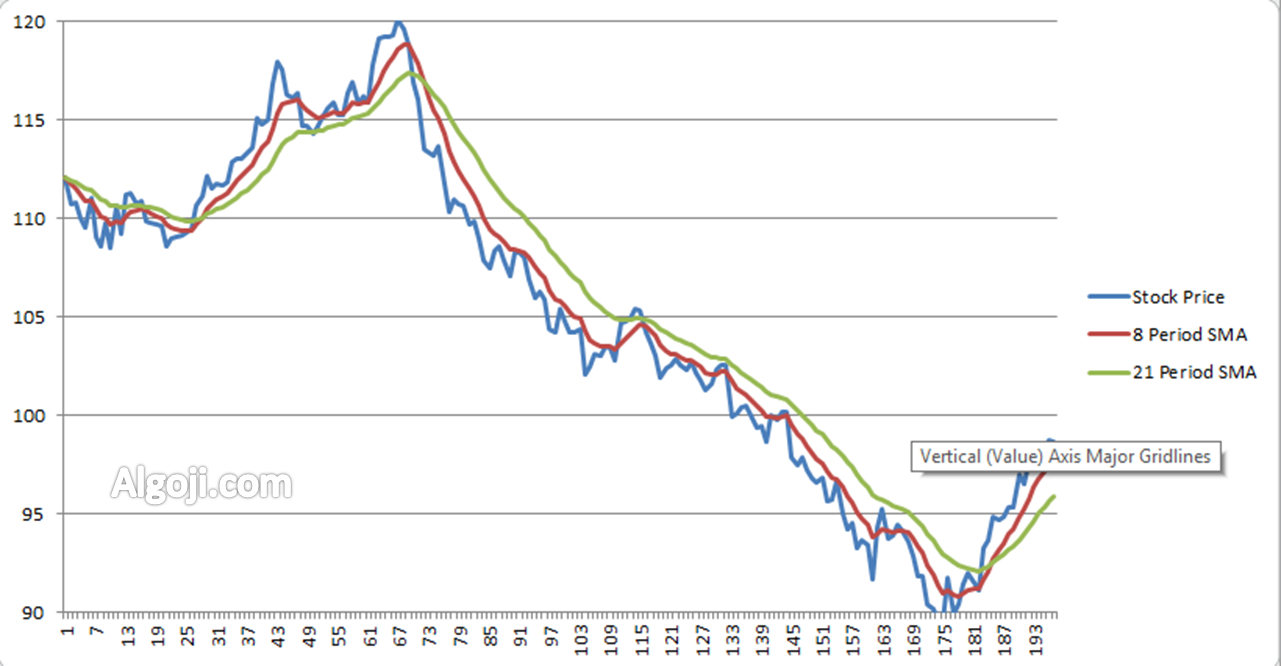

1 hour enter your historical data download and import historical data from a provider such as yahoo finance. This builds on the moving average cross over strategy by going long if the short term sma is above the long term sma and short if the opposite is true. Learn to input data and interpret results within excel.

In cell f21 the formula =if (e21=1,c21,”.”) gets the job done. 120 share 11k views 1 year ago forex backtesting download the spreadsheet here: Manual backtesting simply involves going through your historical charts candle by candle.

Backtesting is the process of analyzing historical trade data to see how a trading strategy would have performed statistically in the past. This is very slow and cumbersome. Backtesting in modeling refers to a predictive model's testing using historical data.

It also calculates technical indicators and has pattern recognition functions. 66k views 8 years ago backtesting trading strategies using random entry. In this column we want to know if we are currently holding a long or a short position.

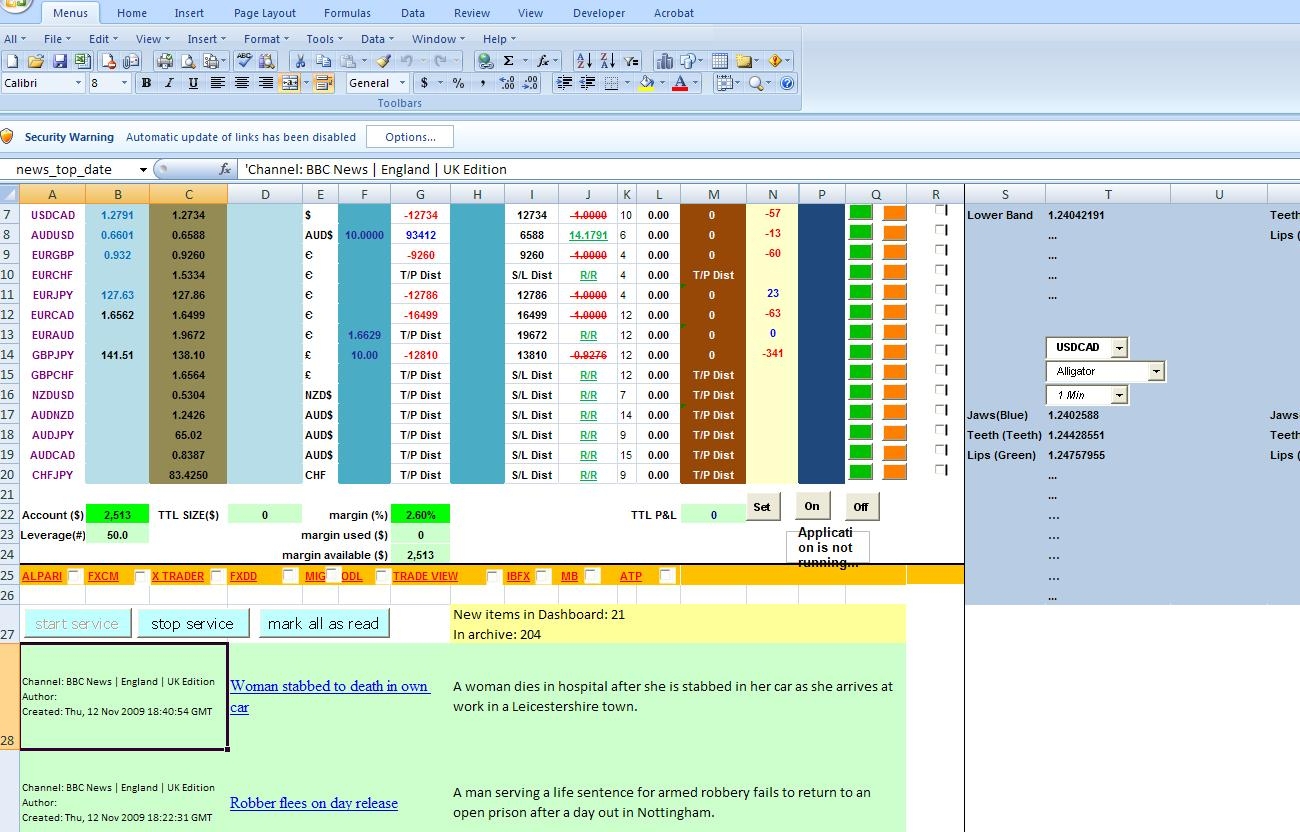

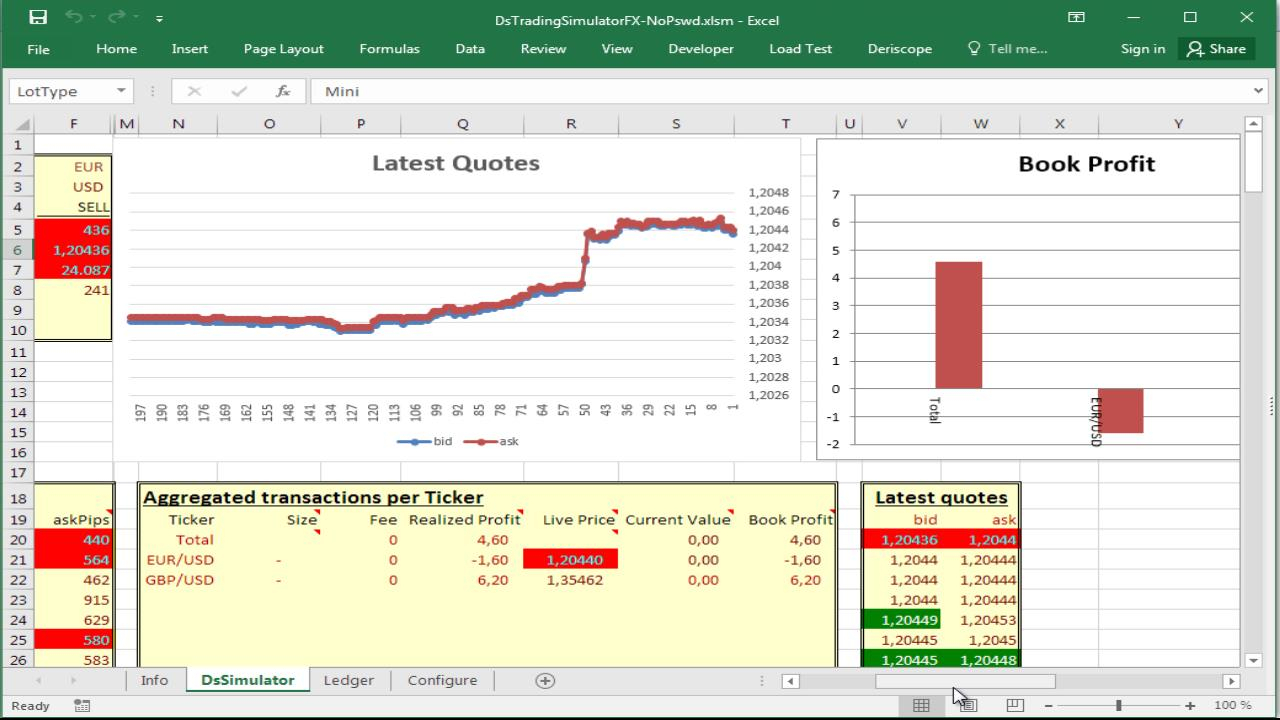

The data we are going to be using is hourly closing prices of sbin starting from 2009 until 2017. Technical analysis excel template with trading strategy back testing the technical analysis template provides analysis for sma, roc, macd, rsi and bollinger band indicators by purpose built excel solutins for business and finanacial decision making follow 164 75 reviews 11,159 views | 7 comments | bookmark download for free This backtesting engine works natively in microsoft excel and also fetches historical stock prices and alternative datasets.

Backtesting in modeling refers to a predictive model’s testing using historical data. You can filter the events by all possible information:

Backtesting excel trading spreadsheet now lets backtest our algorithm on historical data to see how it would have performed in the past. The article is about how to do so in microsoft excel, not about the theoretical background of backtesting. The article is about how to do so in microsoft excel, not about the theoretical background of backtesting.