Spectacular Info About Blank Cash Flow Statement

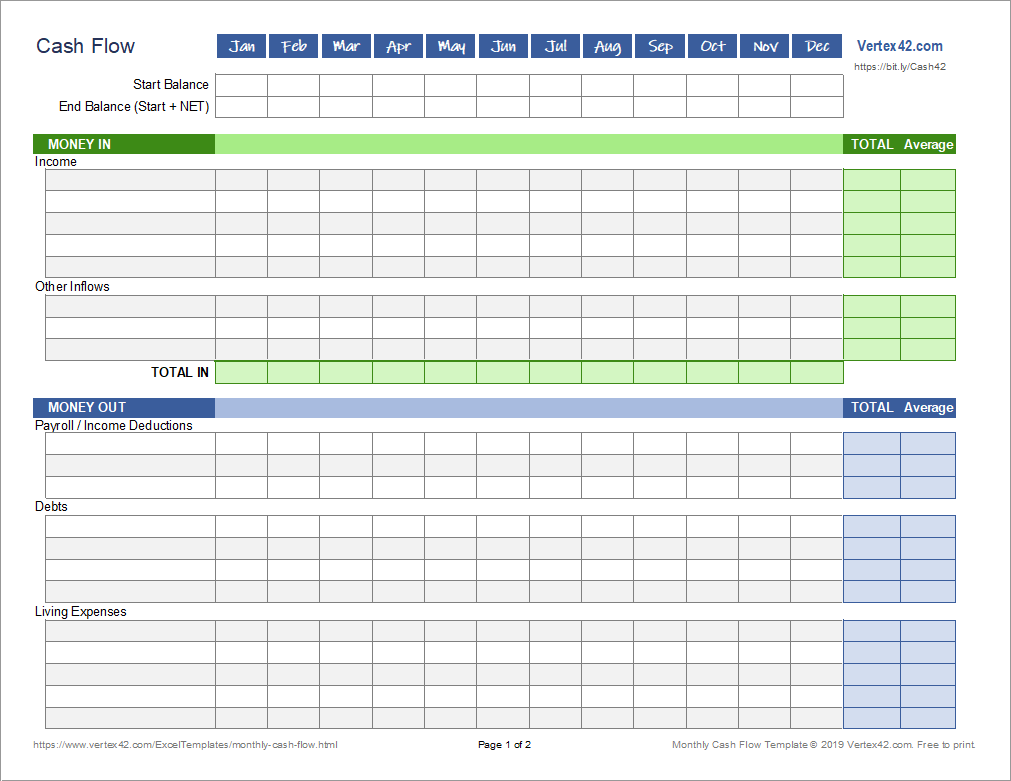

A cash flow statement template is a tool used by businesses to present information about their cash inflows and outflows over a specific period of time.

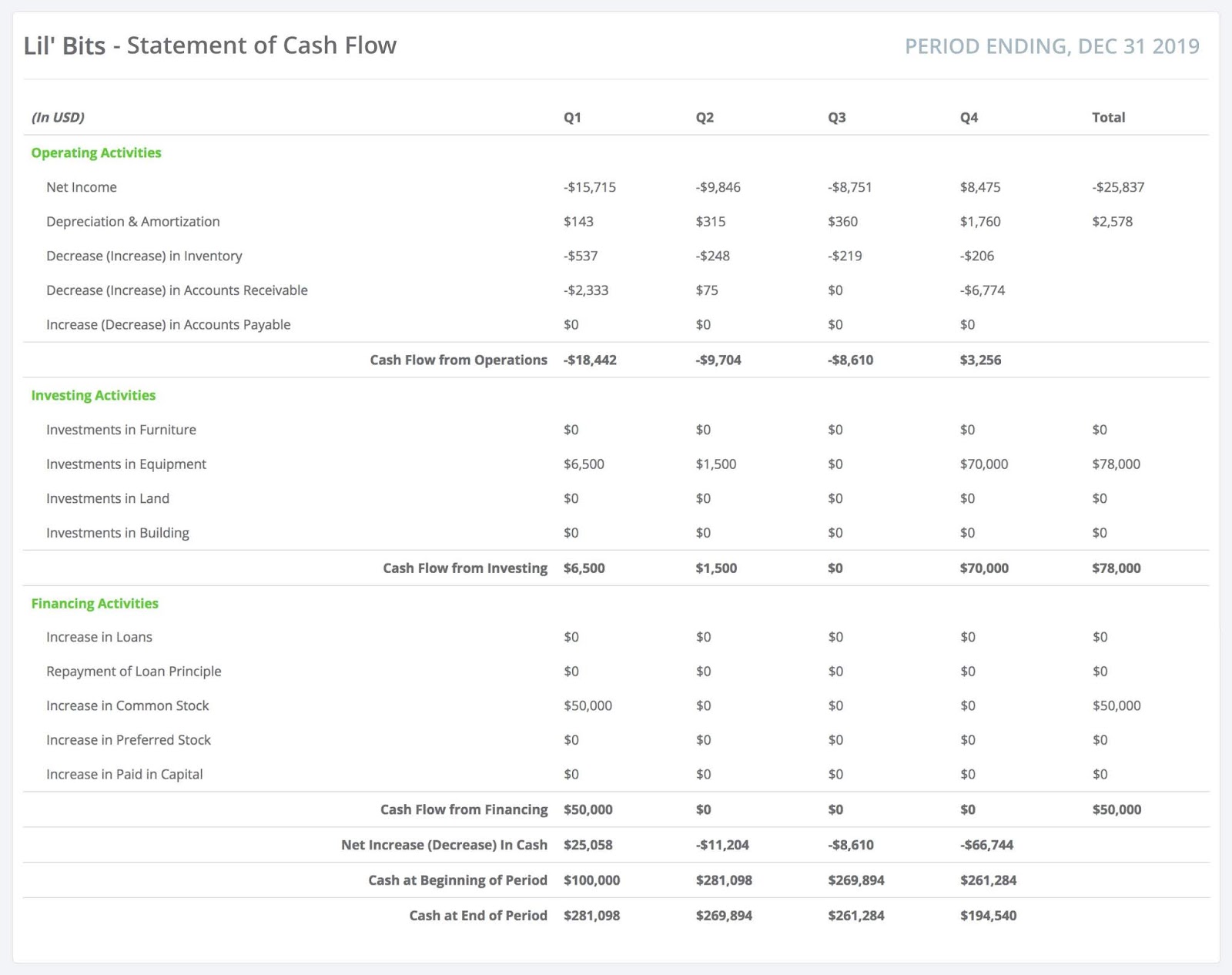

Blank cash flow statement. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. The cash flows of a business are reported on the statement of cash flows. Subtract uses of cash (step 3) from your cash balance (sum of steps 1 and 2).

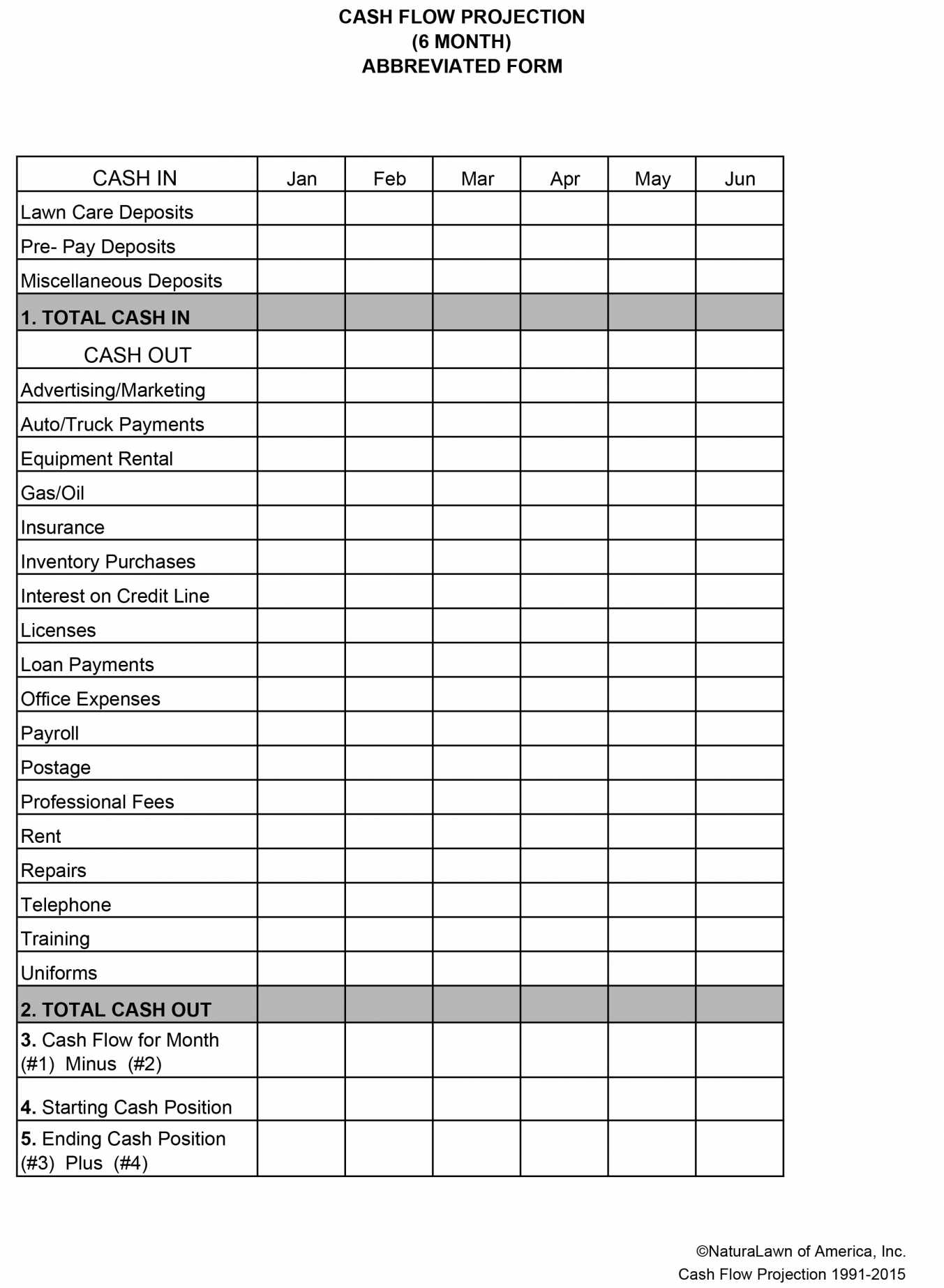

Be sure to place them in the appropriate section (i.e. Using the indirect method, operating net cash flow is calculated as follows:. Choose from 15 free excel templates for cash flow management, including monthly and daily cash flow statements, cash projection templates, and more.

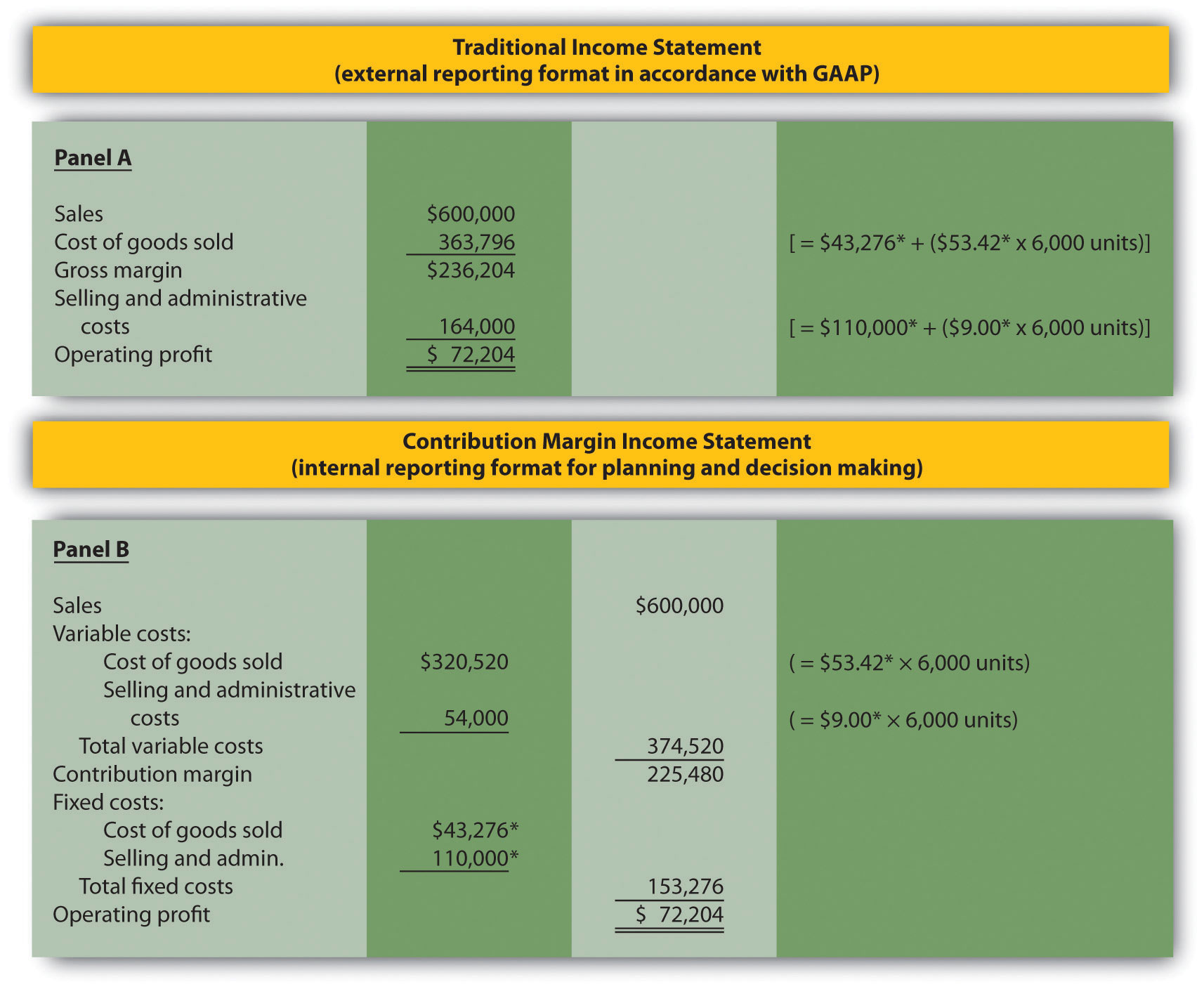

The statement of cash flows is prepared by following these steps:. The cfs highlights a company's cash management, including how well it generates. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. A cash flow statement tells you how much cash is entering and leaving your business in a given period. What is the cash flow statement?

Although the presentation of operating cash flows differs between the two methods,. Free cash flow eur 423 million; According to the online course financial accounting :

Calculate the cash going out. Operating activities, investing activities, and financing activities. Add back noncash expenses, such as depreciation, amortization, and depletion.

Sap s/4hana cloud for finance. Sadly, bills won’t pay themselves, and you must spend in order to make. Operating activities, investing activities, or financial activities).

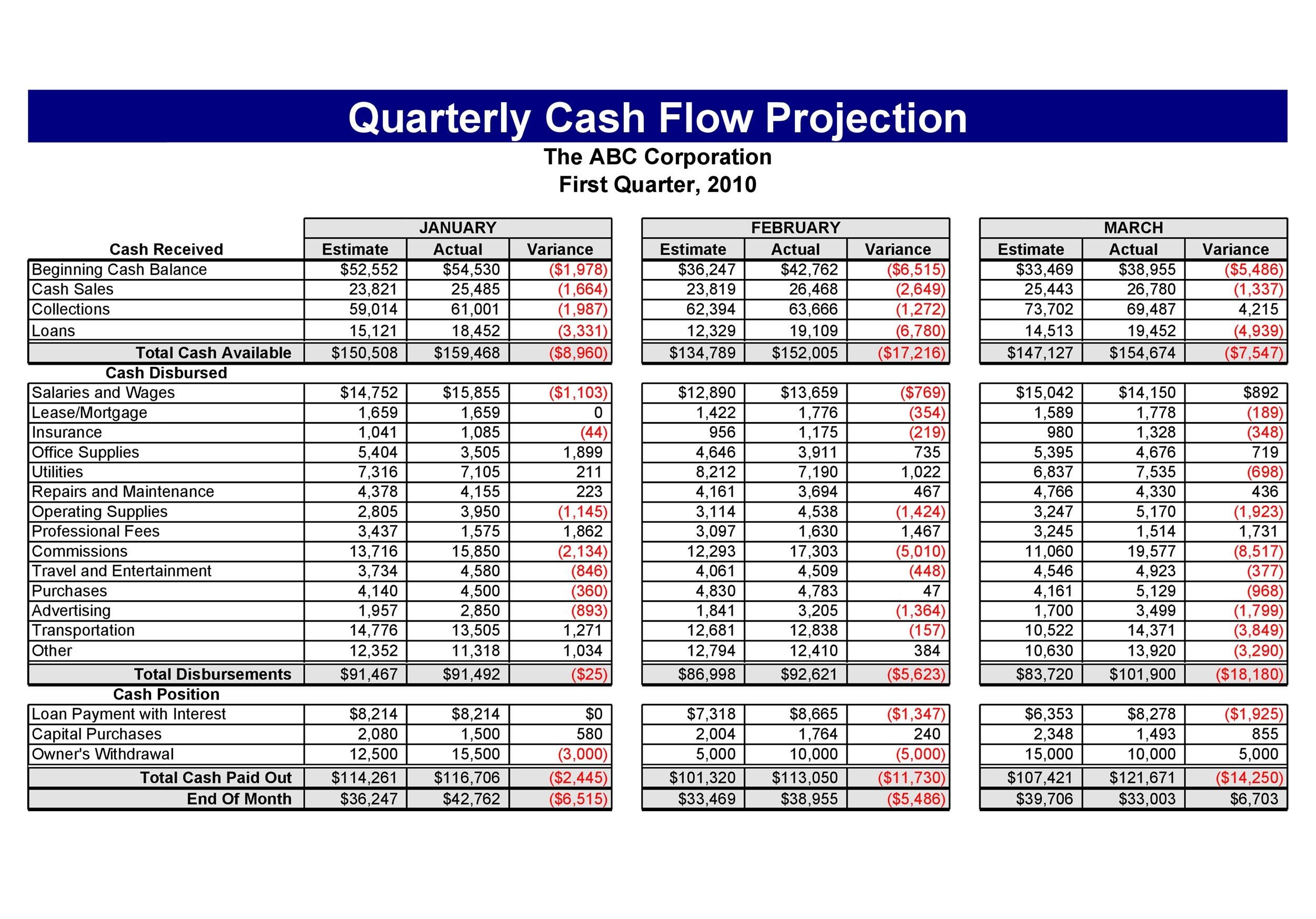

The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Please suggest list of best practices that should be activated to prepare cash flow statement both direct and indirect methods for the purposes of statutory reporting and managerial reporting and planning. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established under accrual accounting. The template typically includes three main sections: To know from where cash comes from in a business, a statement is prepared called a.

A cash flow statement shows how cash moves in and out of your business during a specific period of time, such as a month or a quarter. Try smartsheet for free, today. Ceo statement “in 2023, we delivered another strong and resilient performance.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)