Best Tips About Bill Payoff Spreadsheet

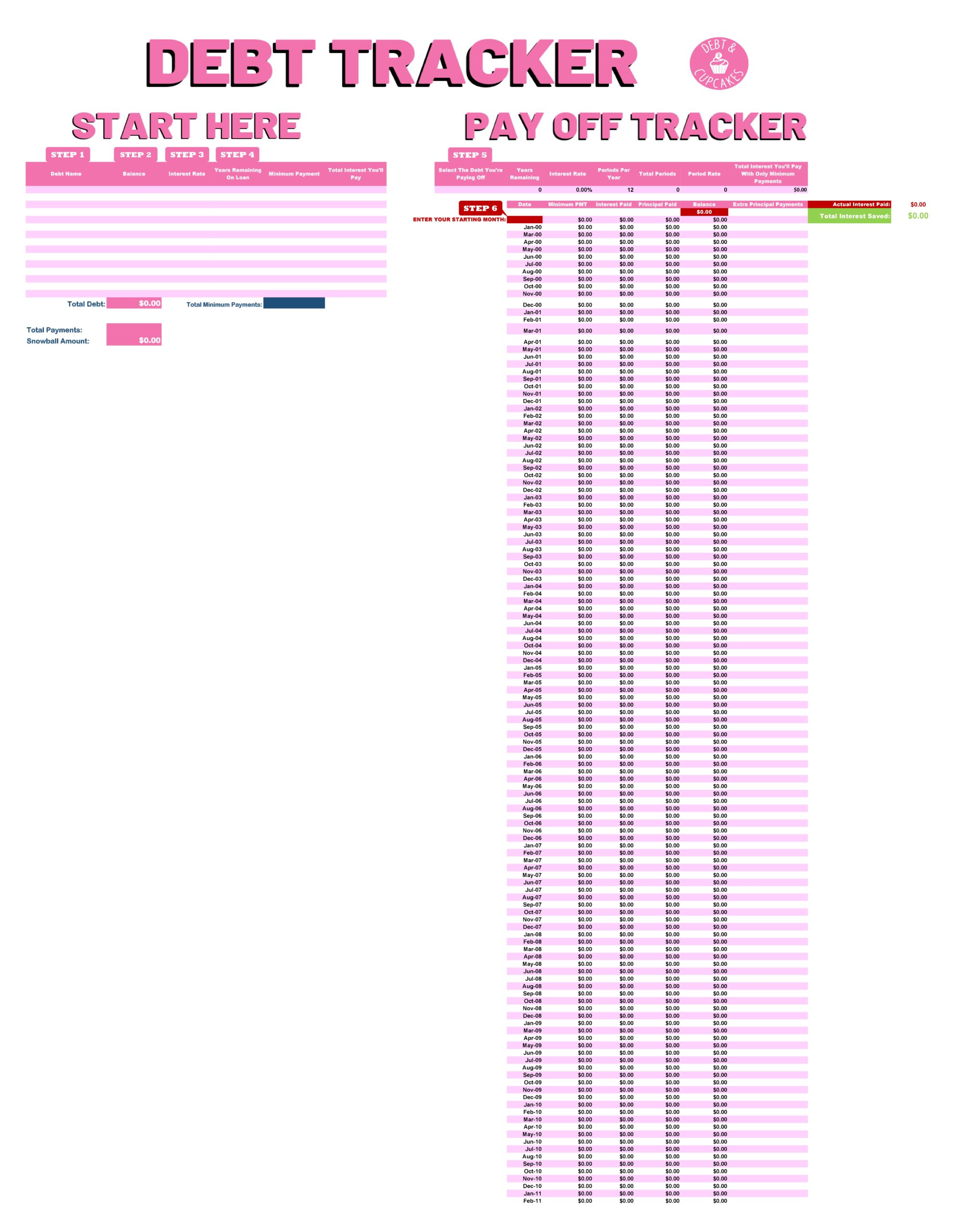

Enter the loan name in column a enter the principal balance in column b enter the interest rate in column c (this column is.

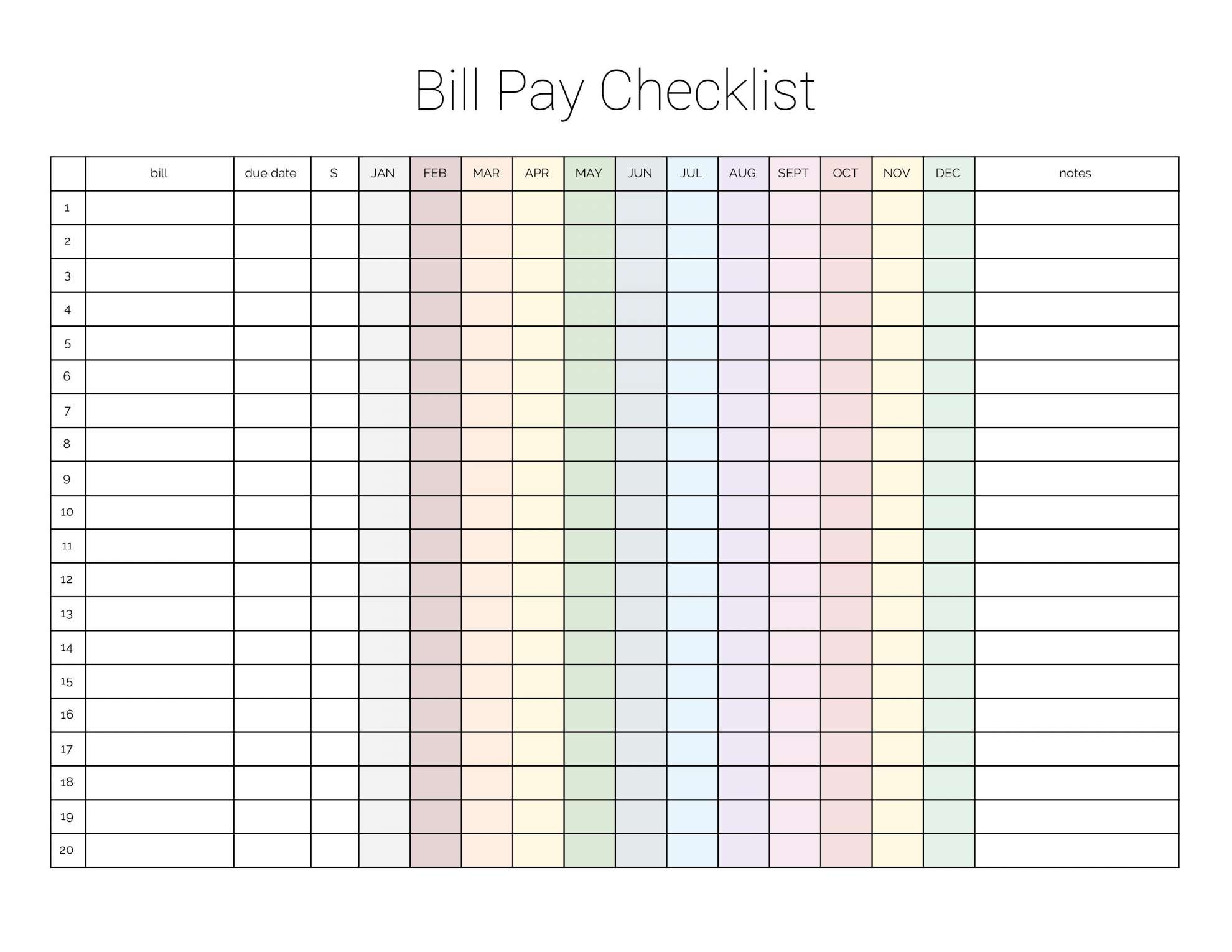

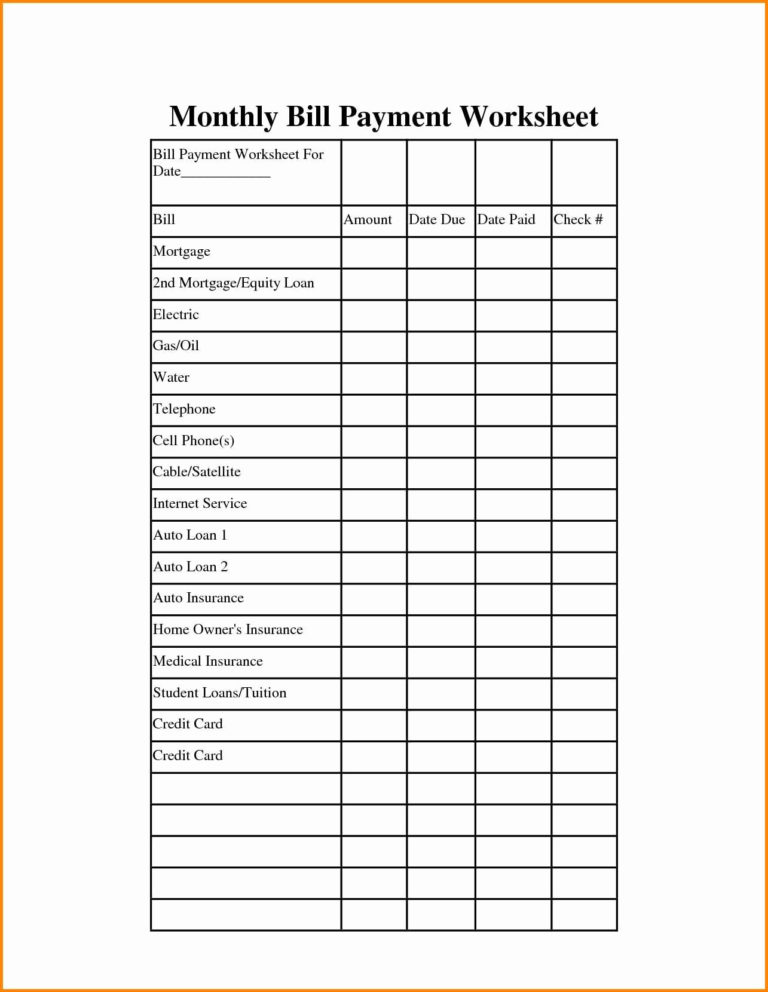

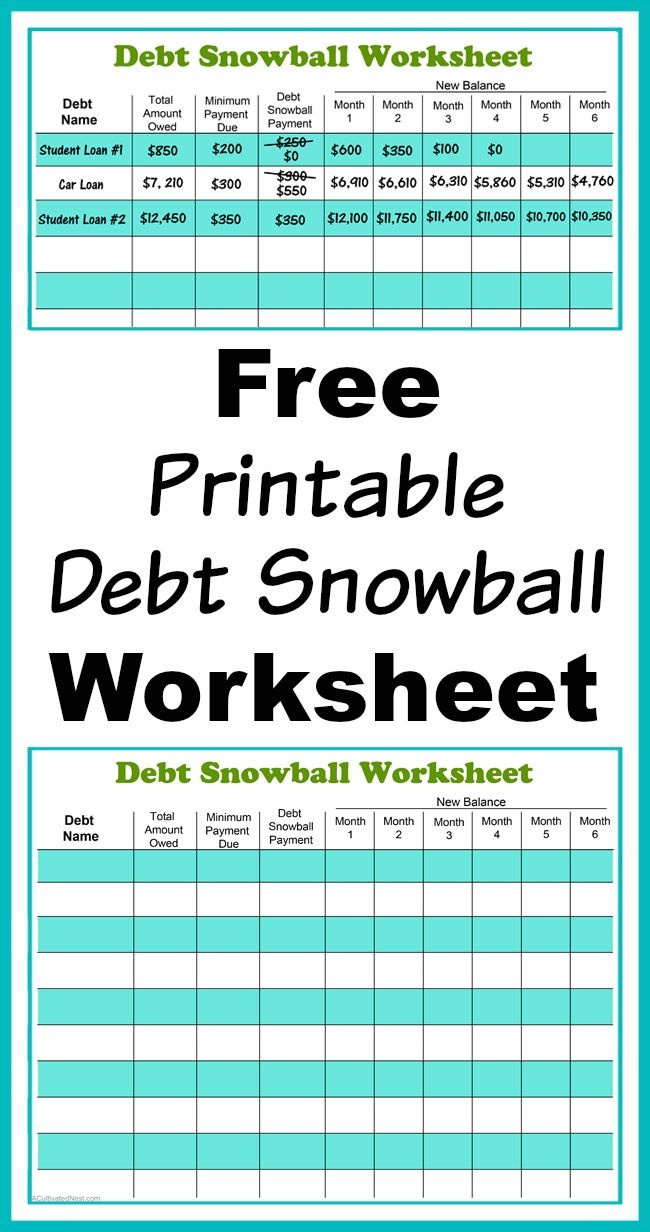

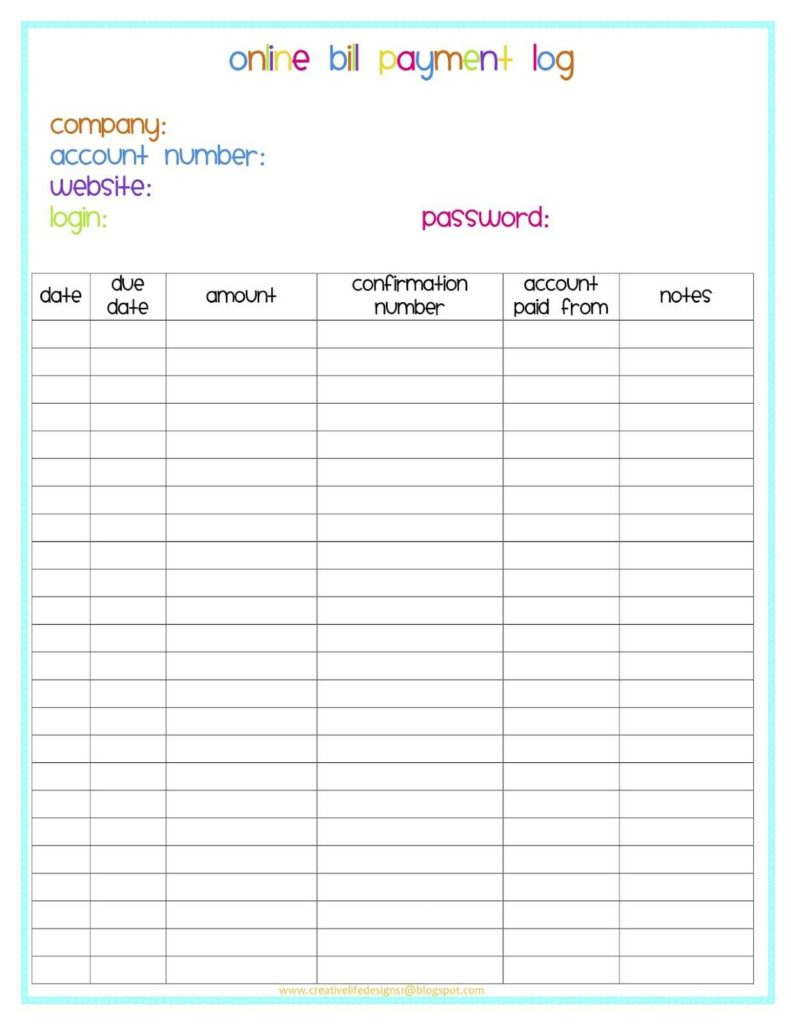

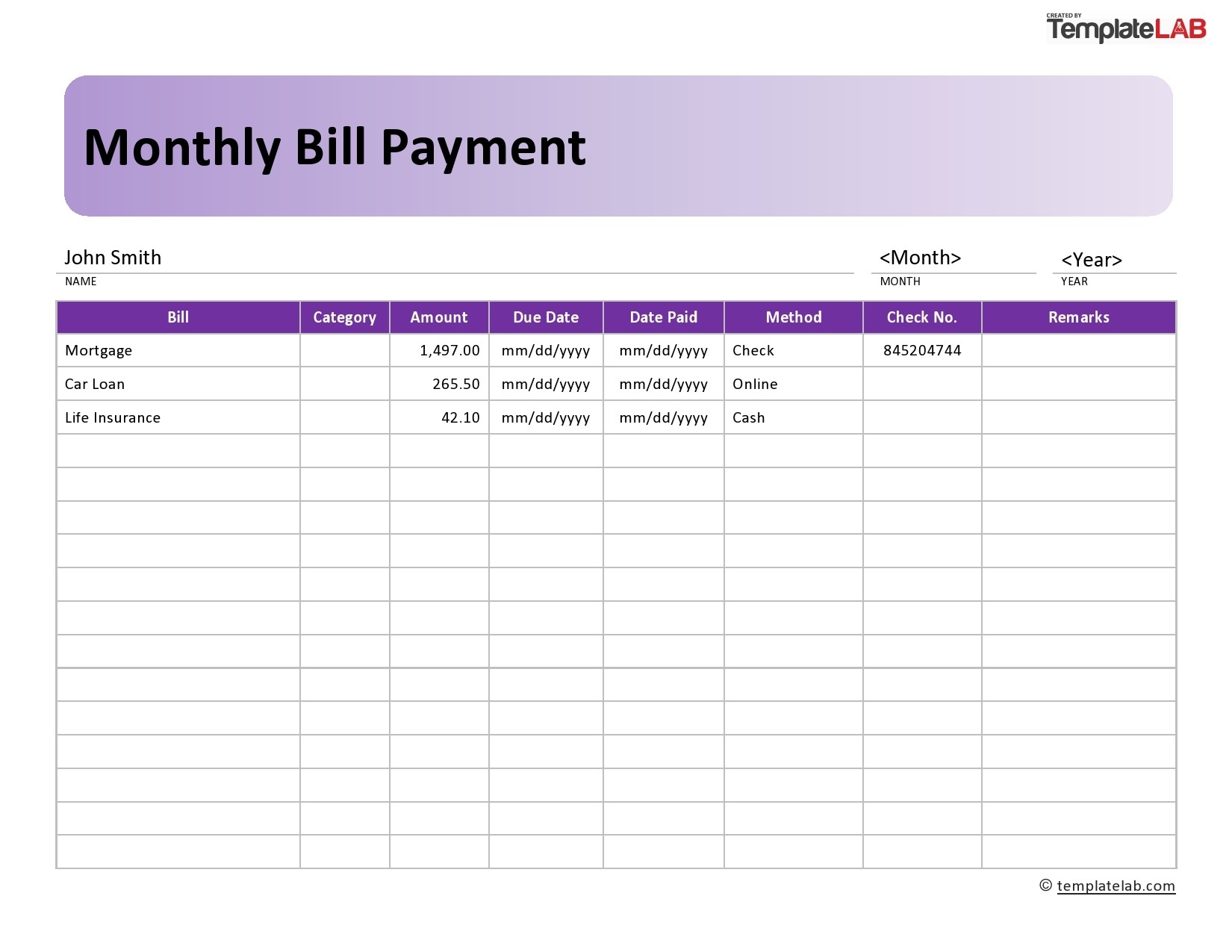

Bill payoff spreadsheet. Here is how it works. Use snowball, avalanche, or whatever payoff strategy works best for you. A bill payment tracker spreadsheet is perfect for people who prefer manual tracking, or a combination of automated and manual bill tracking.

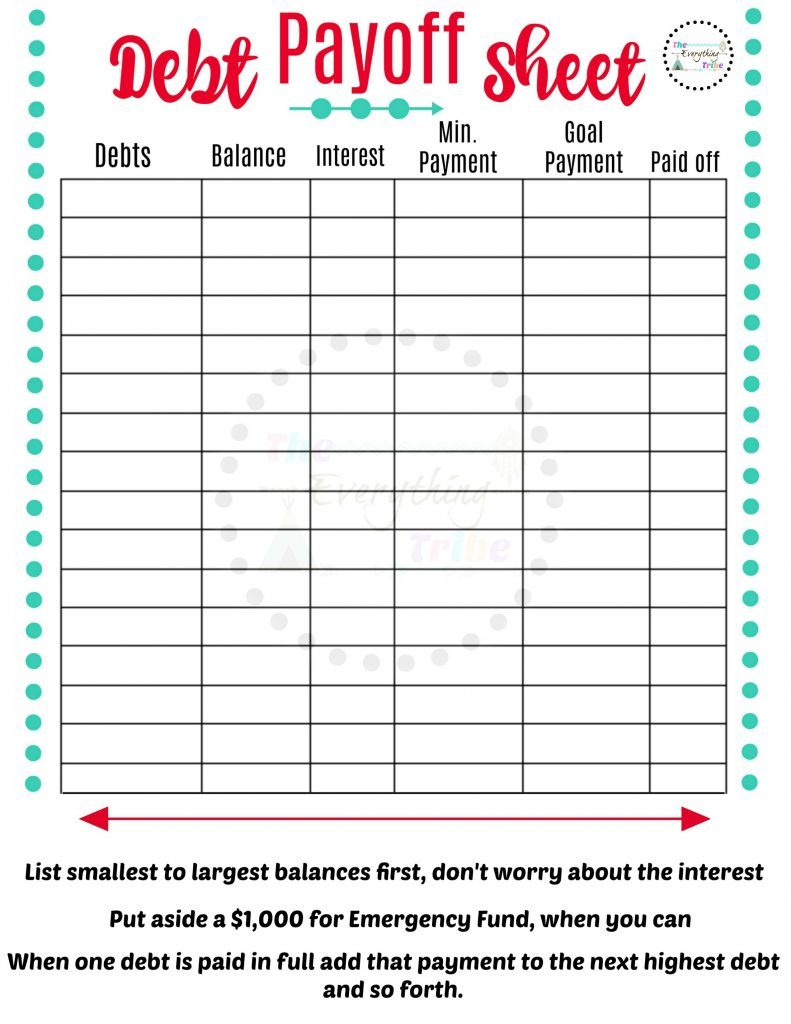

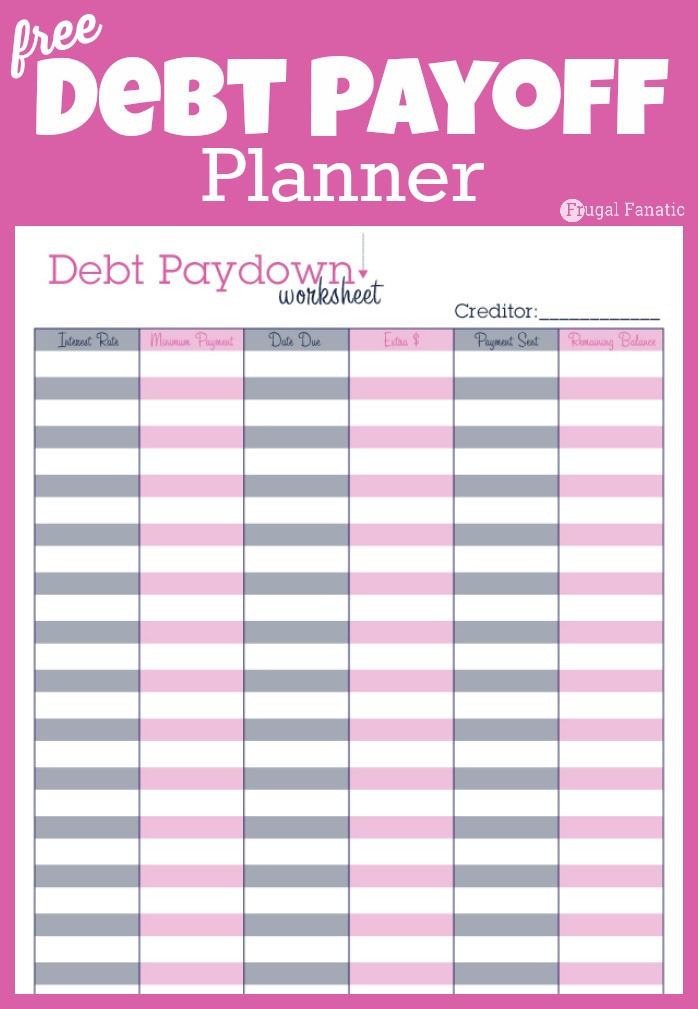

You start by listing your debts from smallest to. How to use the google sheets loan payoff template: Whether you want to use an excel spreadsheet or.

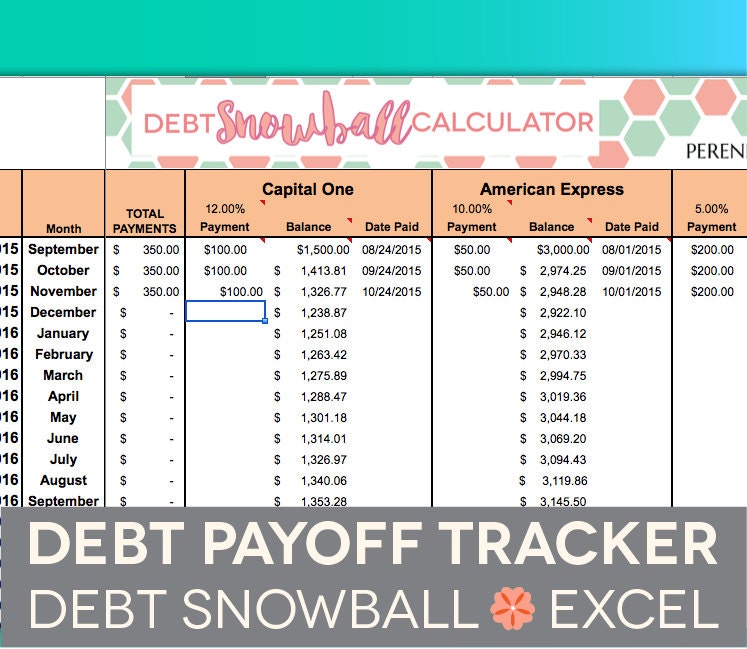

Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. The calculator below estimates the amount of time required to pay back one or more debts. These spreadsheets work best with the debt snowball method.

Some are labeled as “credit card payoff spreadsheets,” or “student loan spreadsheets,” but they all keep. This debt payoff excel spreadsheet will allow you to record both the interest you pay as noted on your bill statement as well as your extra payment. Edit the labels for each column and then enter the minimum payment (min) and start debt (sd) amounts.

Description track multiple debts with a single worksheet. The bill payoff spreadsheet by spreadsheet daddy is a google sheets spreadsheet you can begin working with right away if you need to start a payment plan. It’s a way of planning steps you’ll take in order.

Essentially, all debt payoff spreadsheets are the same. One of the best methods available for getting rid of debt is known as the snowball method. Debt snowball spreadsheet 38 debt snowball spreadsheets, forms & calculators have you ever heard of the snowball method?

These templates help you organize, track, and pay your bills on. If you need help organizing your debts and budgeting for repayment, a bill organizer or budget planner app like undebt.it may be a wise choice. Repeat this step for the other debts, but don’t include the extra payment yet.