The Secret Of Info About Statement Of Functional Expenses Template

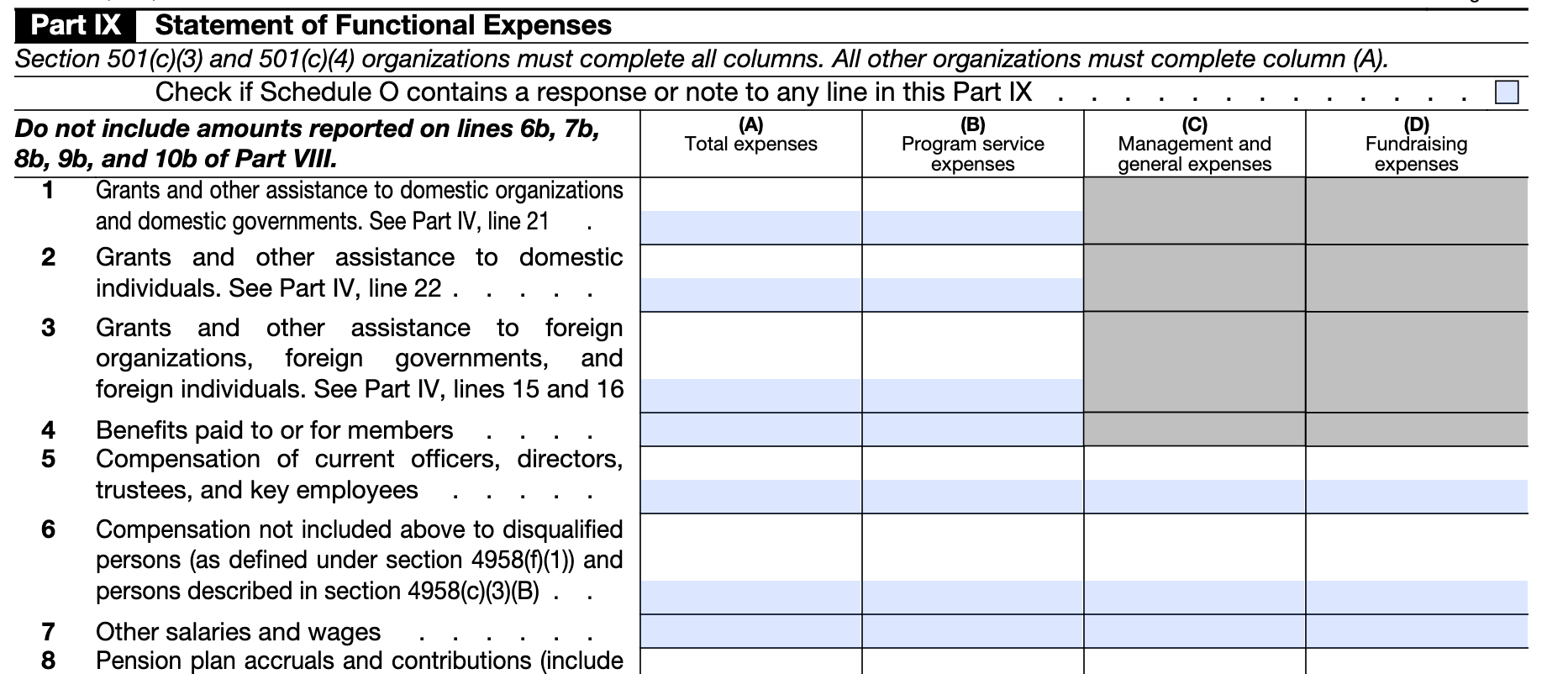

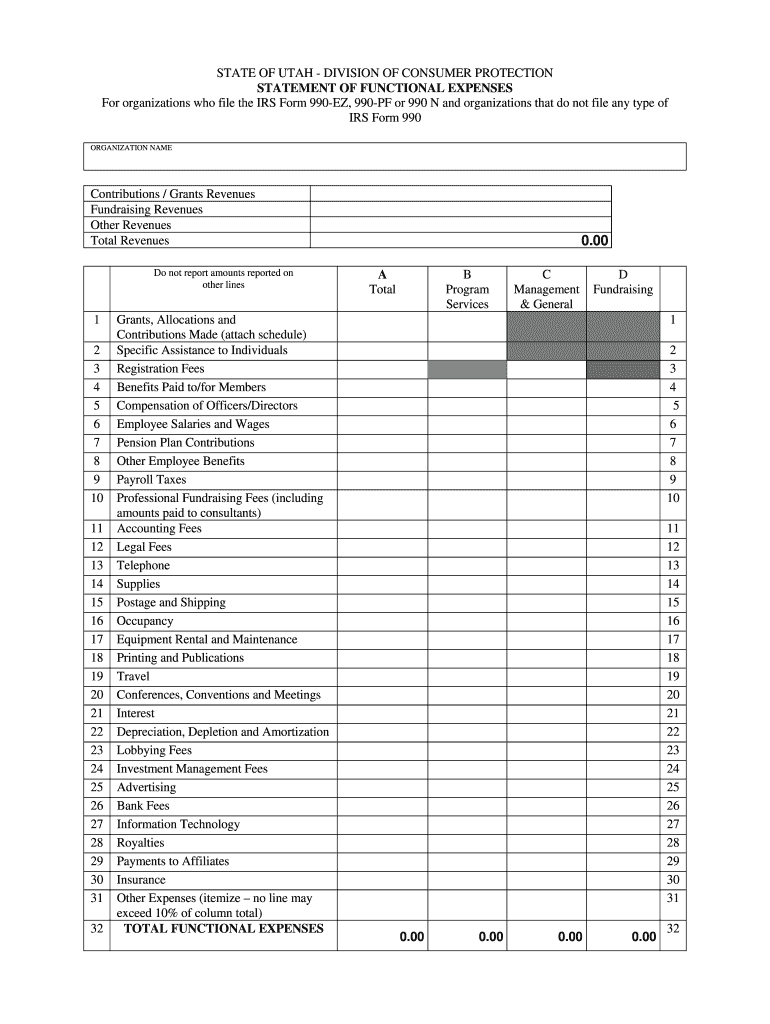

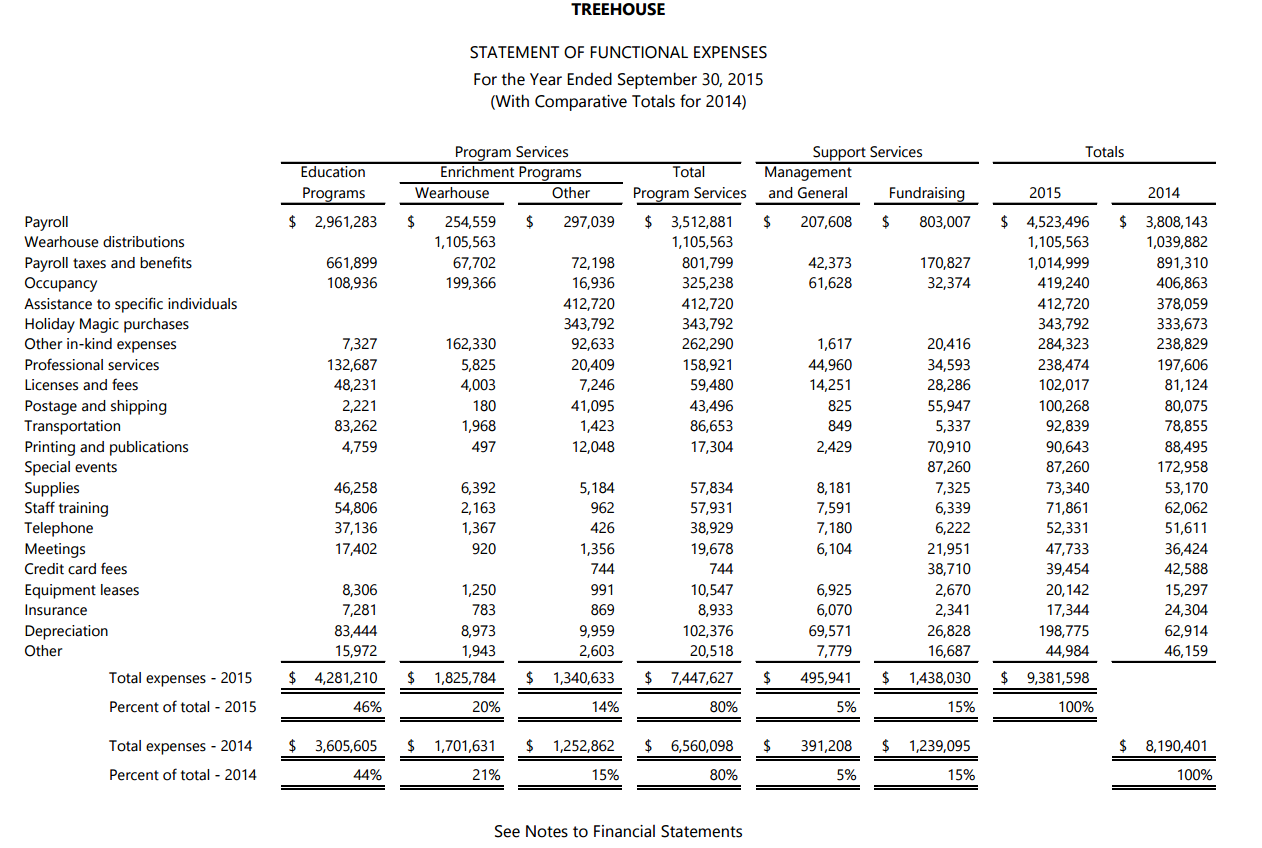

The purpose of the functional expense is to present the expenses in a way that helps analyze the functional classification, such as major programs and the supporting services, but also shows the natural categories of expenses.

Statement of functional expenses template. A statement of functional expenses is used to show how expenses are incurred for each functional area of a nonprofit entity. The statement of functional expenses allows the nonprofit to categorize, classify, and clearly record the expenses and functionality of expenses made by the organization. Rather, it’s a way of looking at how you spent your money, according to the function that money accomplished.

The natural categories are items such as salaries, rent, electricity, depreciation, grants to others and professional fees. The statement of functional expenses is a critical tool for nonprofits, detailing their expenses across various functional categories. Statement of functional expenses.

Key components of the statement of functional expenses. Functional areas typically include programs, fundraising, and management and administration. Nonprofit statement of functional expenses template.

When designing the functional expense statement, the first step for an organization is to define its functions. The statement of functional expenses is described as a matrix since it reports expenses by their function (programs, management and general, fundraising) and by the nature or type of expense (salaries, rent). The purpose of a statement of functional expenses is to show how much of your money and time you spent on each of the categories mentioned above.

Let’s get started with an overview of the statement of functional expenses and how it fits into your nonprofit’s financial management practices. Nonprofit's statement of functional expenses. If your nonprofit is required to prepare a statement of functional expenses, our form provides the layout.

Functional expense classification refers to the purpose for which the expenses were incurred, such as program activities and support services. Categories of functional expenses for nonprofits. The sfe reports expenses by their function (programs, management and general, fundraising) and by the nature or type of expense (salaries, rent).

Nonprofit accountants need to know how to help their clients create a statement of functional expenses. The statement of functional expenses provides a detailed breakdown of a nonprofit organization’s financial activities. An easy way to allocate these expenses if by having your volunteers and.

Before you can use any of the allocation methods outlined below, you need to understand functional classifications. It provides an insightful lens into how an organization manages its finances, ensuring transparency, accountability, and strategic allocation of resources. Purpose of the statement of functional expenses.

Included in the course resources are various financial statement examples and common ratios used in analyzing nfp financial statements. A guide to nonprofit accounting hub accounting april 17, 2023 functional expenses are reported by their functional classification and recorded in a statement of functional expenses. Our forms are educational as well as time savers.

The form has the column headings you need as well as the most common expense categories. Effortlessly track and communicate your nonprofit's financial allocations with our nonprofit organization statement of functional expenses template. It includes components such as program services, management and general expenses, fundraising expenses, and total expenses.