Unbelievable Tips About Debt Tracking Spreadsheet

The spreadsheet will also show you the total number of.

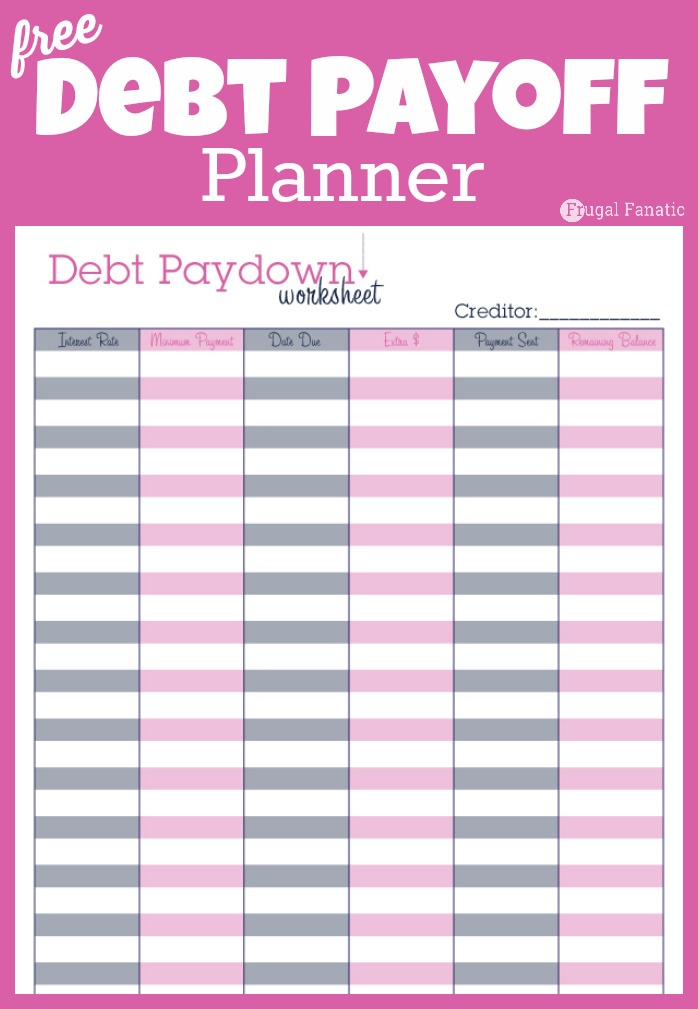

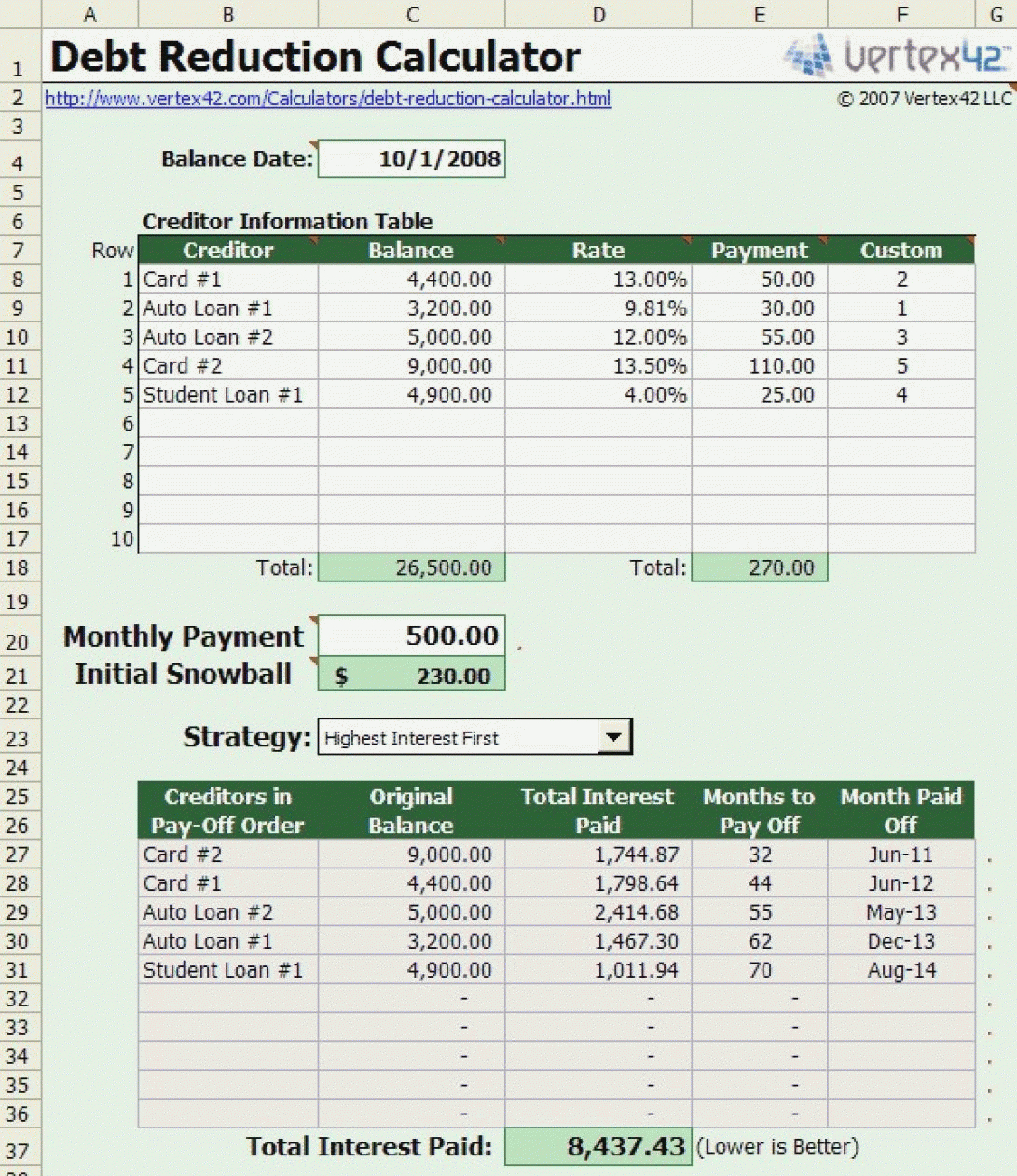

Debt tracking spreadsheet. Examples include vertex42 debt snowball worksheet, it’s your money debttracker spreadsheet, squawkfox debt tracker spreadsheet, life and my finances debt snowball. A debt tracker spreadsheet is a system for monitoring debt, debt payments and how long it will take you to pay that debt off. It can be a basic notebook or sophisticated tool, such as an app, spreadsheet or calculator.

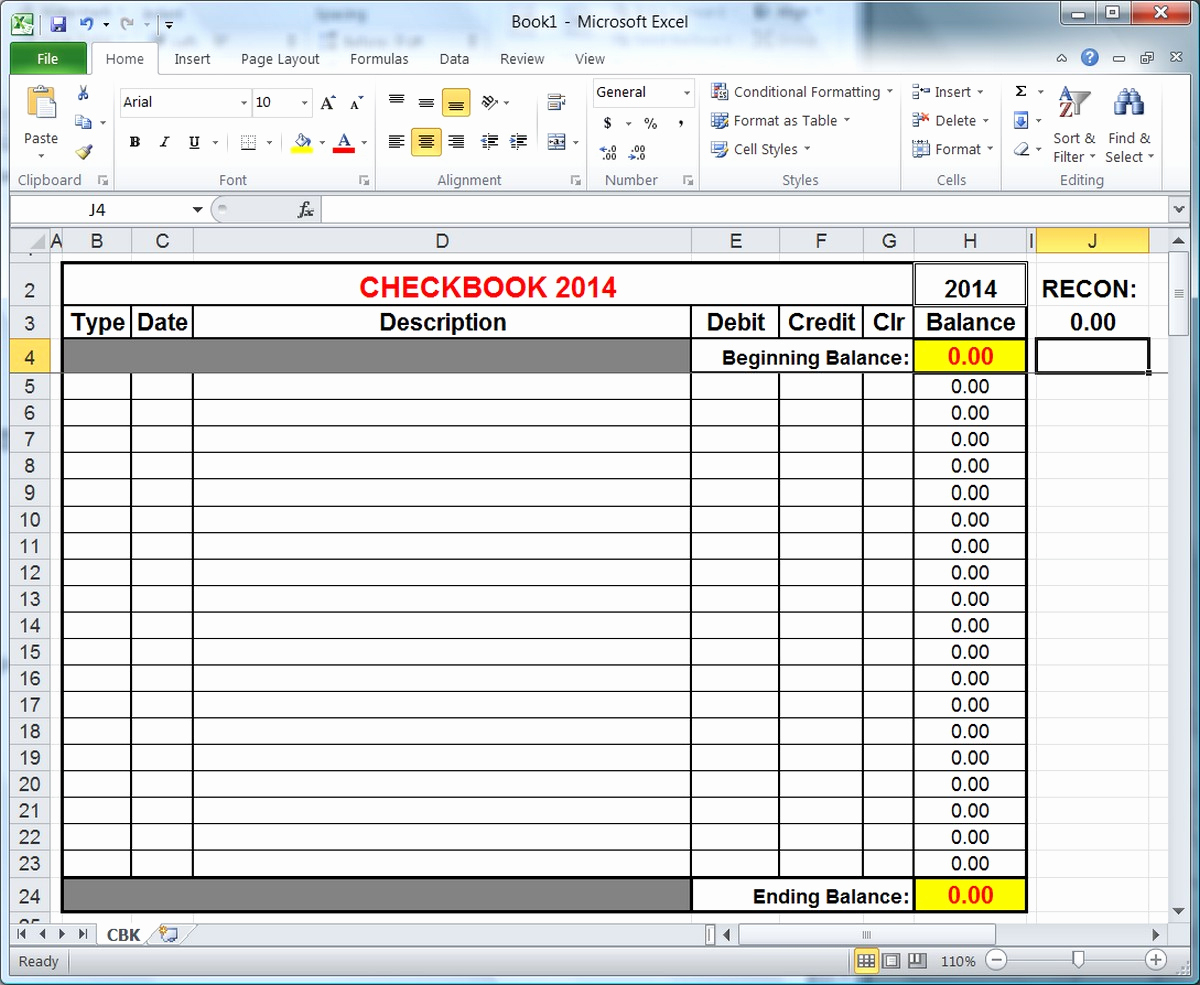

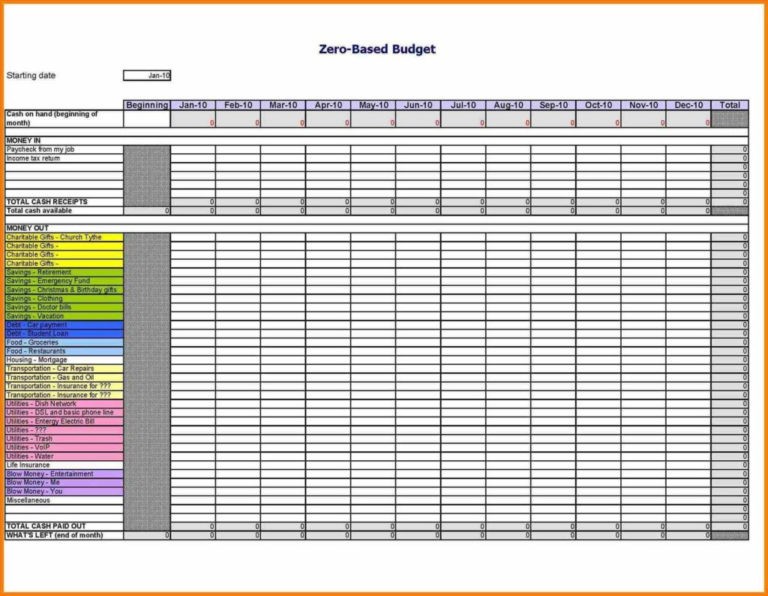

Track your expenses, list it all in a spreadsheet, and compare the final tallies to your monthly cash inflow. The personal debt schedule template designed by spreadsheet daddy is your personal guide, helping you keep track of your debt repayment schedule in a clear and organized manner. This page is a collection of various excel templates to manage debt and loans.

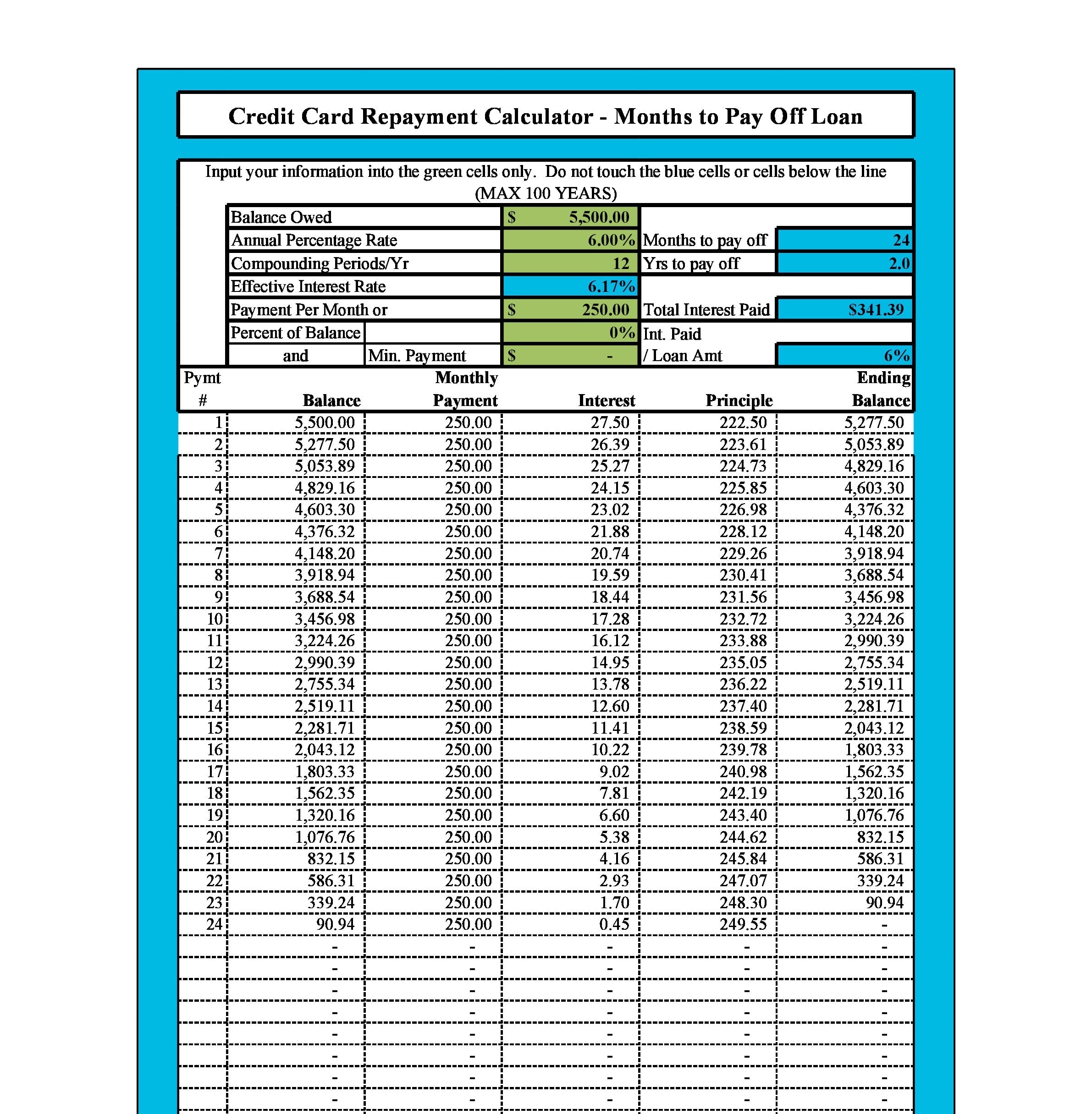

Debt tracker spreadsheets: Start your debt snowball now. Free credit card payoff calculator free debt snowball spreadsheet free debt avalanche excel spreadsheet free debt snowball vs avalanche calculator free budget calculator how to calculate your credit card payoff in excel and google sheets—a.

The article provides a list of recommended debt tracker spreadsheets, highlighting their unique features and functionalities. Here's how to use the free debt reduction spreadsheet in excel: Plug in your loan balance, then let google sheets automatically calculate your milestones in 5% increments.

Let us quickly discuss a few benefits of google sheets: The first way to boost your financial wellness is to truly assess what you are spending and what you are saving. Debt snowball spreadsheet using google sheets is an excellent way to track your debts.

To name a few, our selection includes various loan payment calculators, credit card and debt reduction calculators, payment schedules, and loan amortization charts. There are 6 loan templates with a total of 72043 downloads! Using a debt tracker can be key to paying.

Choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. Repeat until each debt is paid in full. It also helps you plan how fast you can be debt free.

Find a budgeting spreadsheet the first order of business to paying off any debt is working out a budget. Here’s how the debt snowball works: All pages are 100% free.

For example, if you are starting today, enter december 21. Add dates in column a of your debt payoff spreadsheet. List your debts from smallest to largest regardless of interest rate.

Enter the credit card payoff calculator excel sheet— similar calculators and templates: Input your debt—from the highest interest down to the lowest interest (from left to right) in the data tab. Starting with whatever month it is, enter the name of the month and the year in cell a3.