Spectacular Info About Credit Card Expense Form

Xlsx | pdf file page:

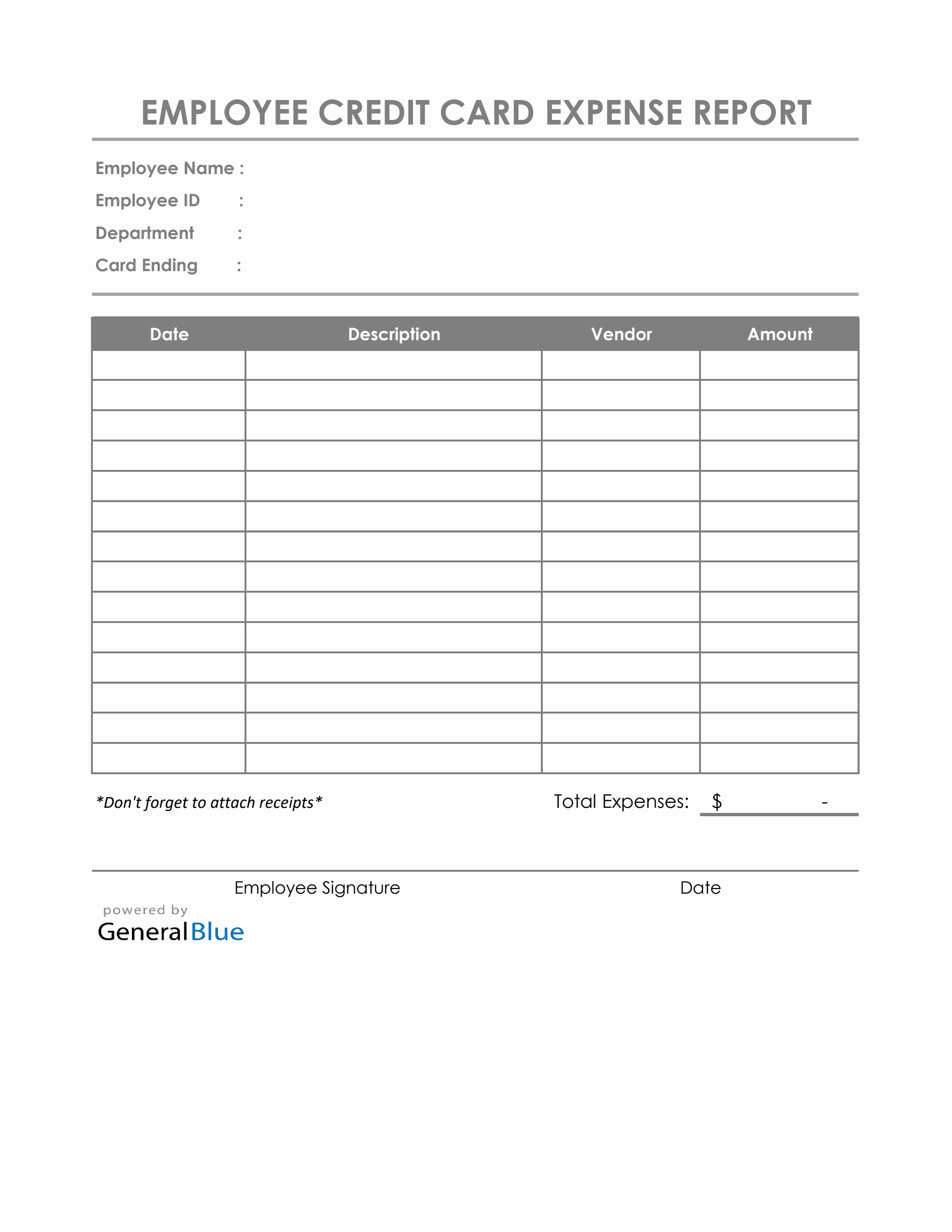

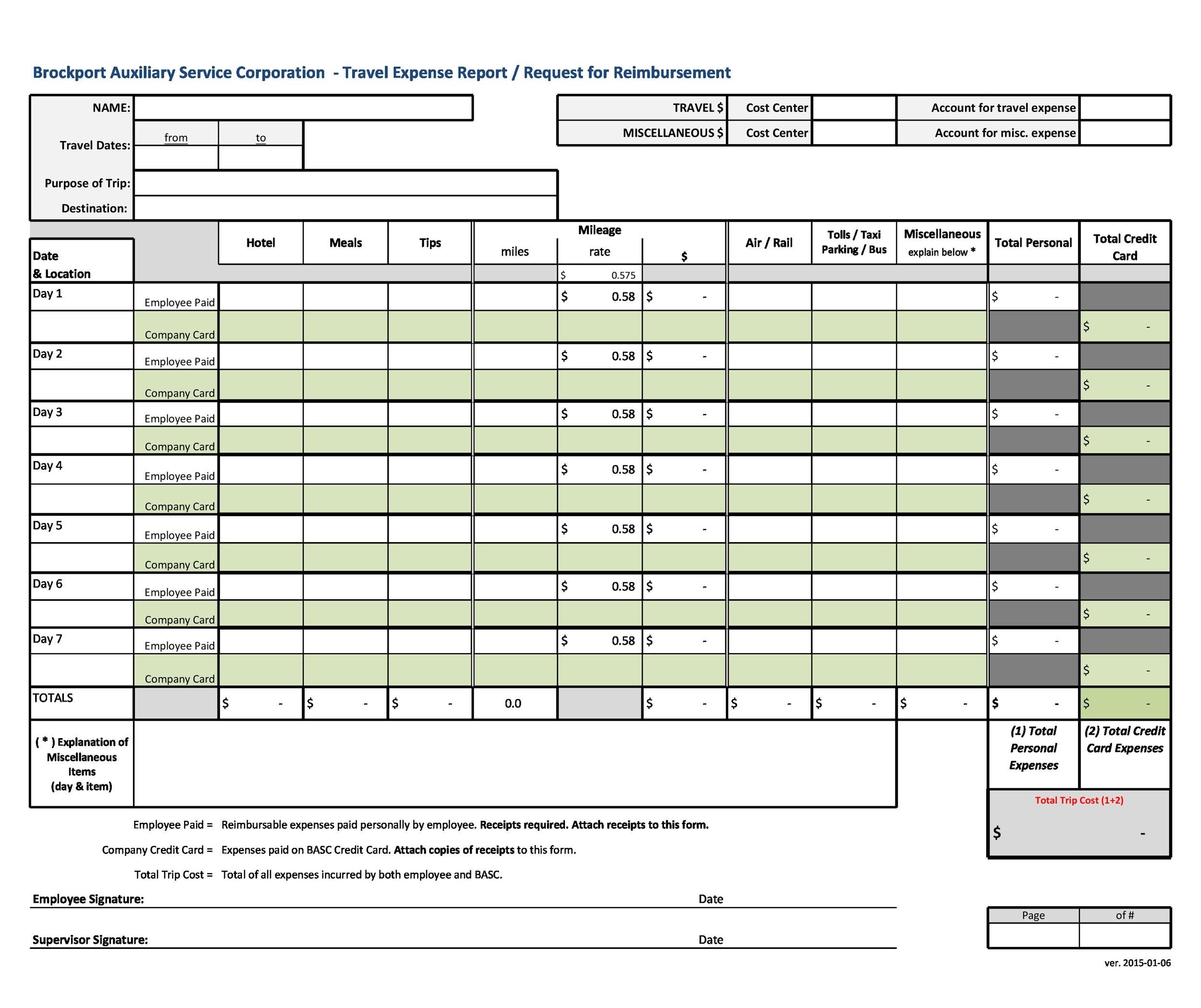

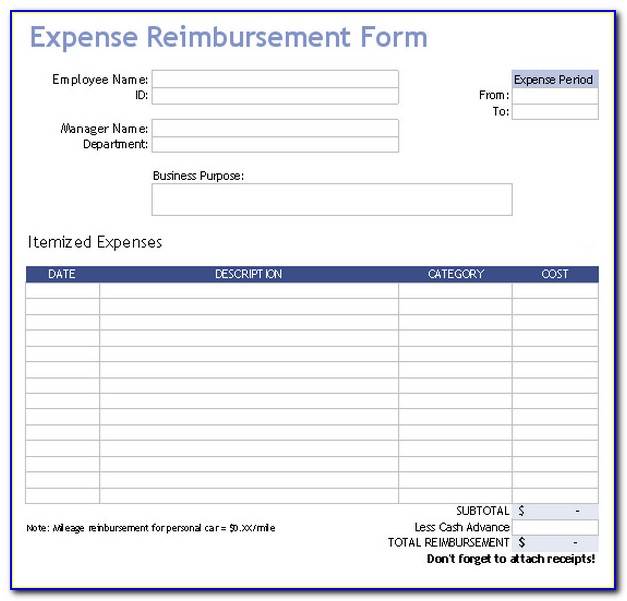

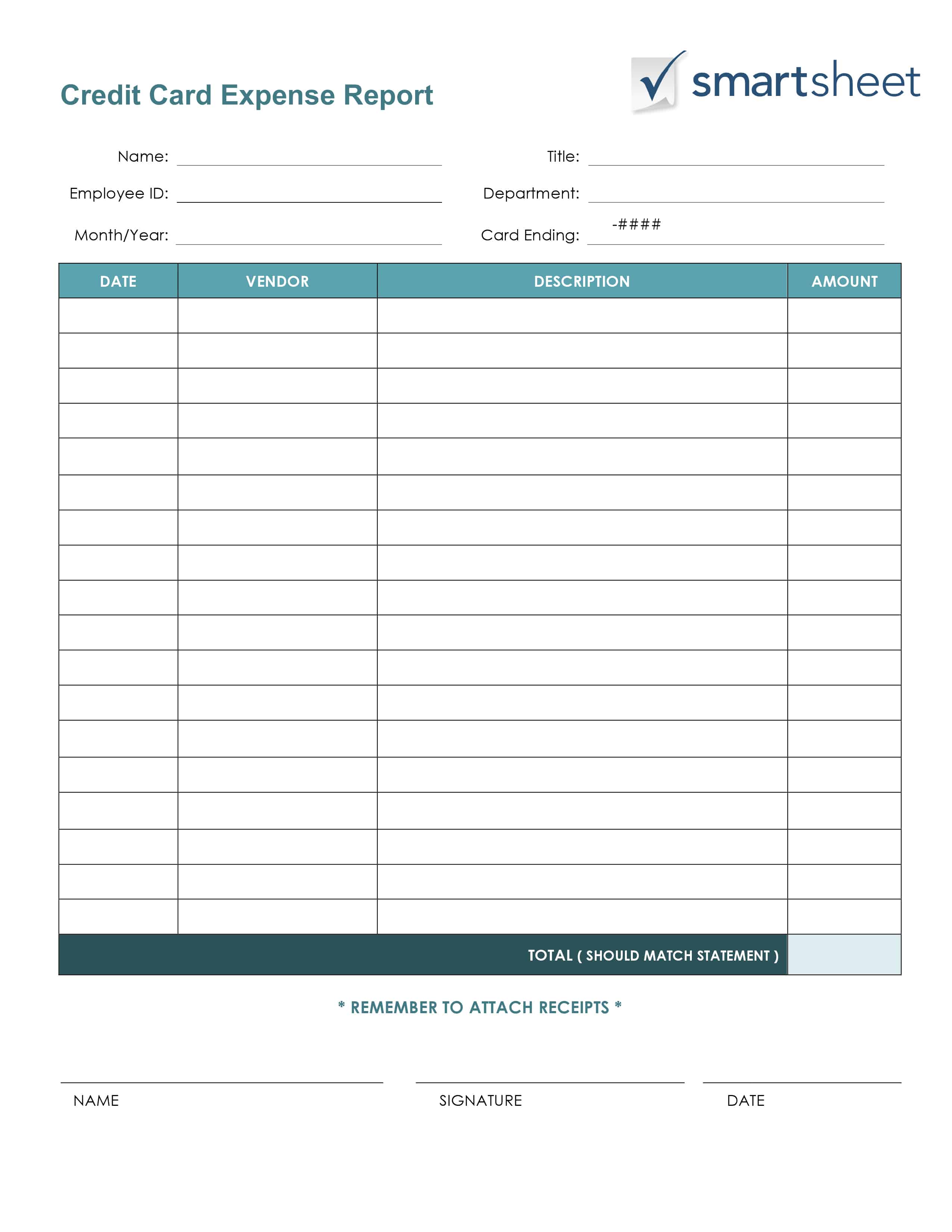

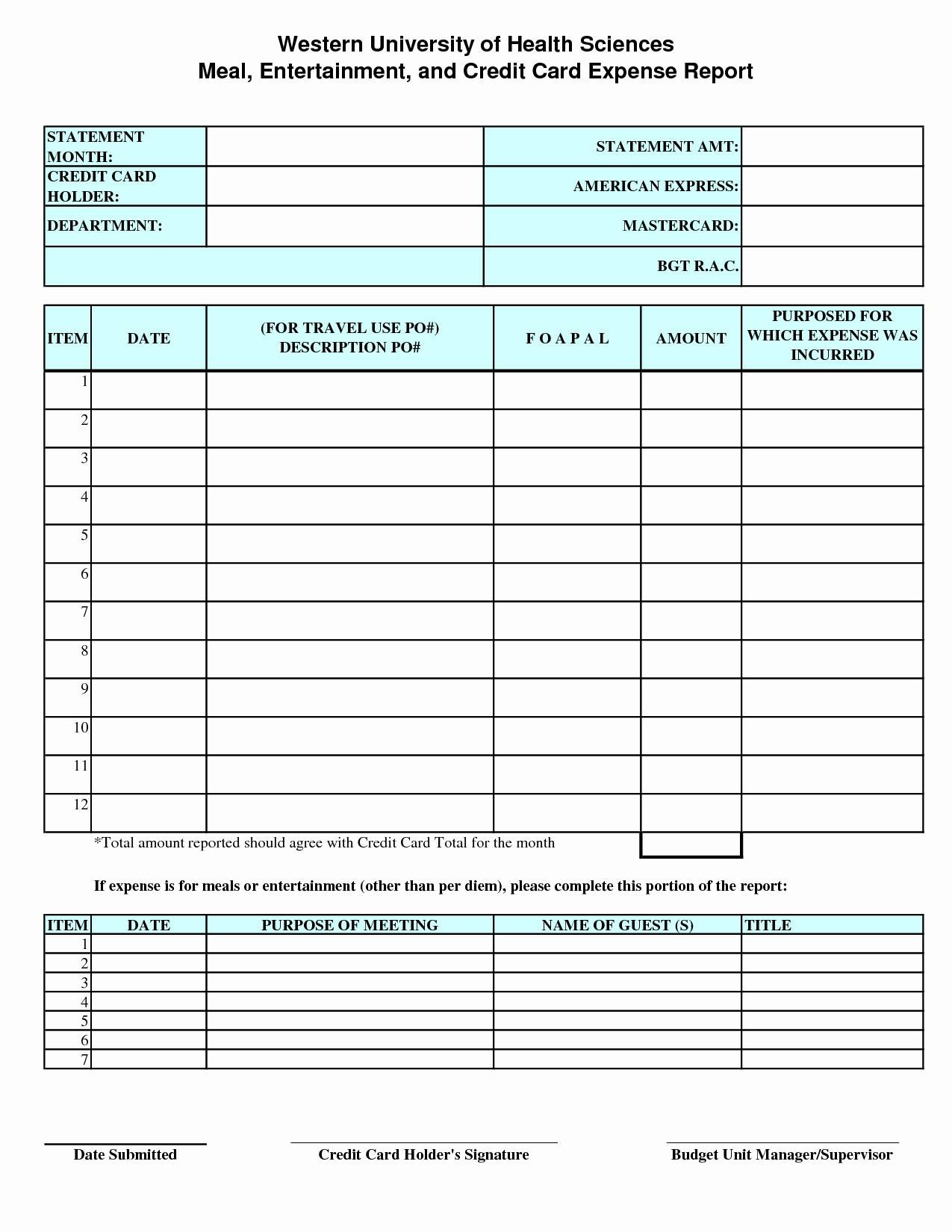

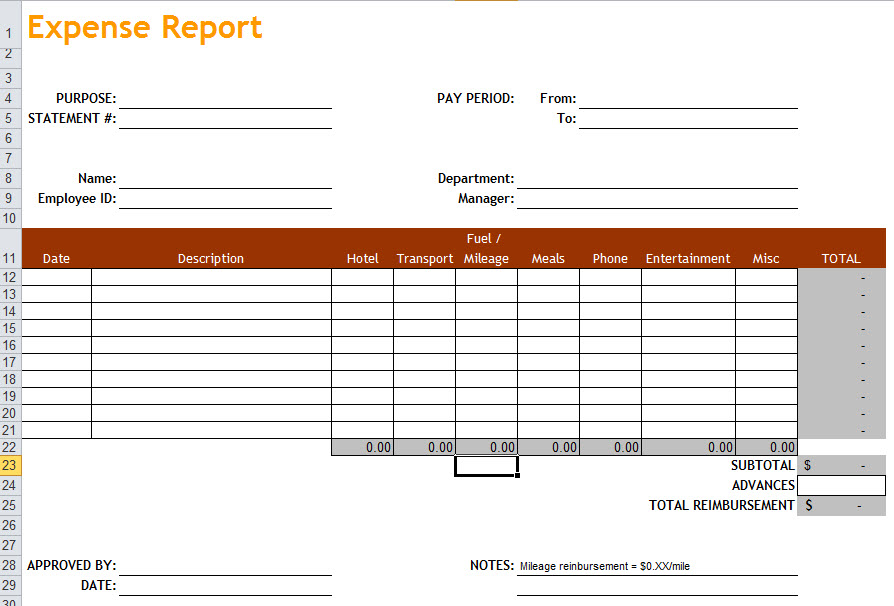

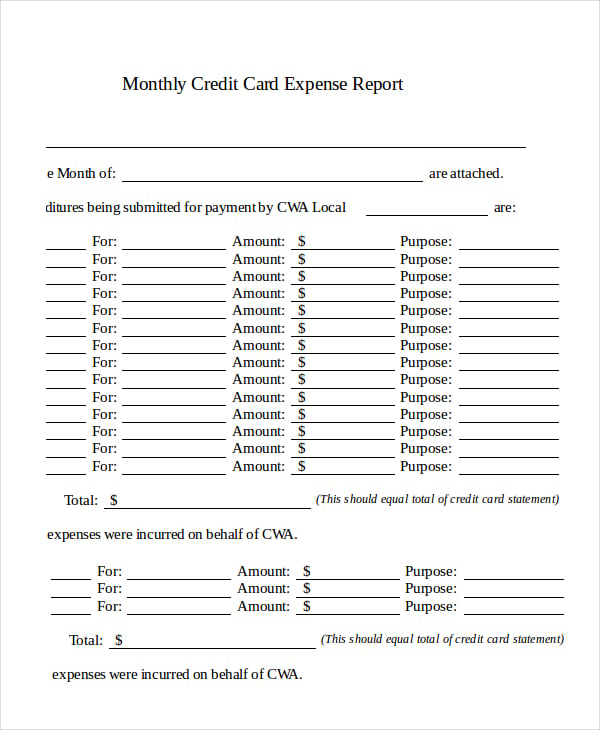

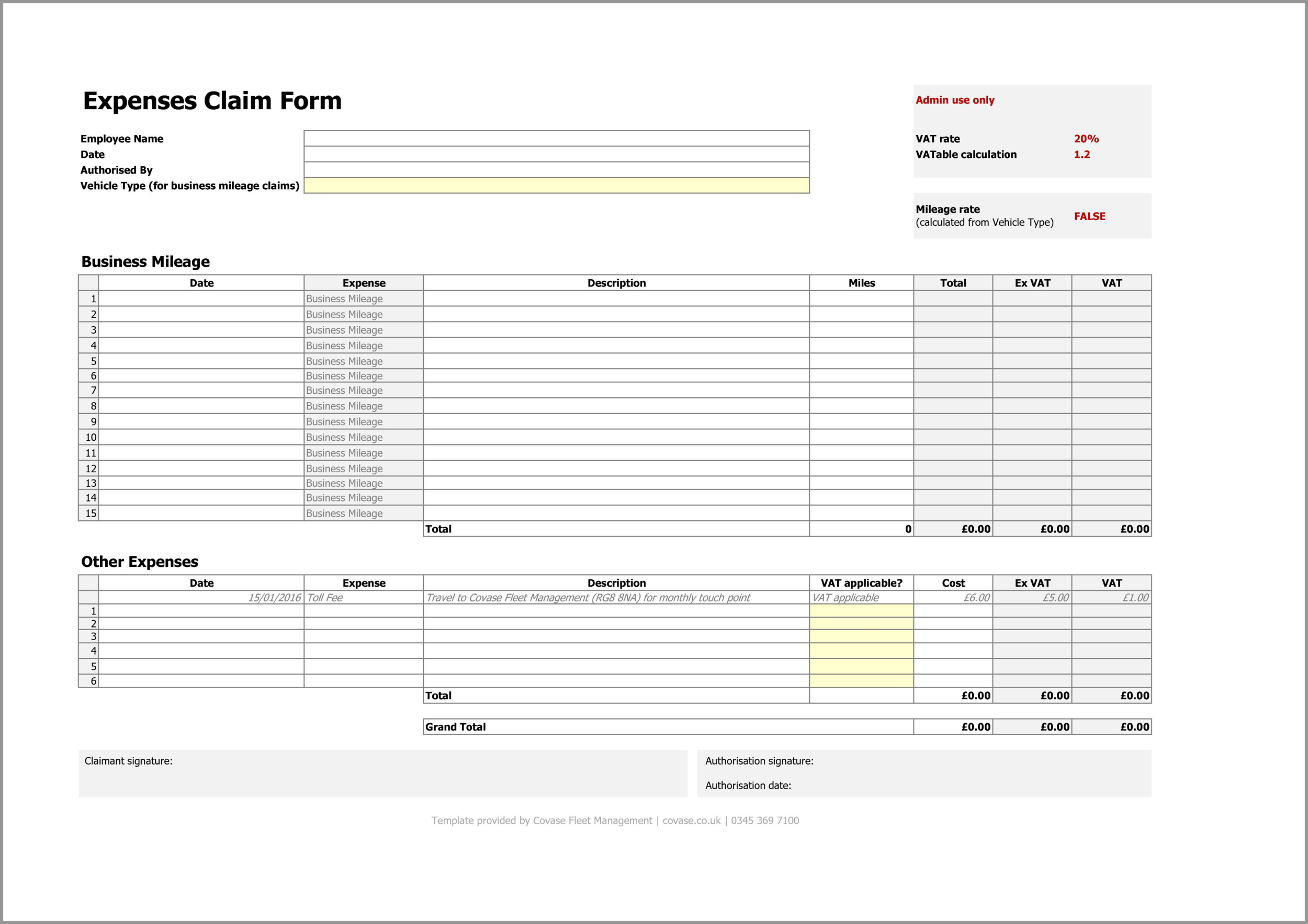

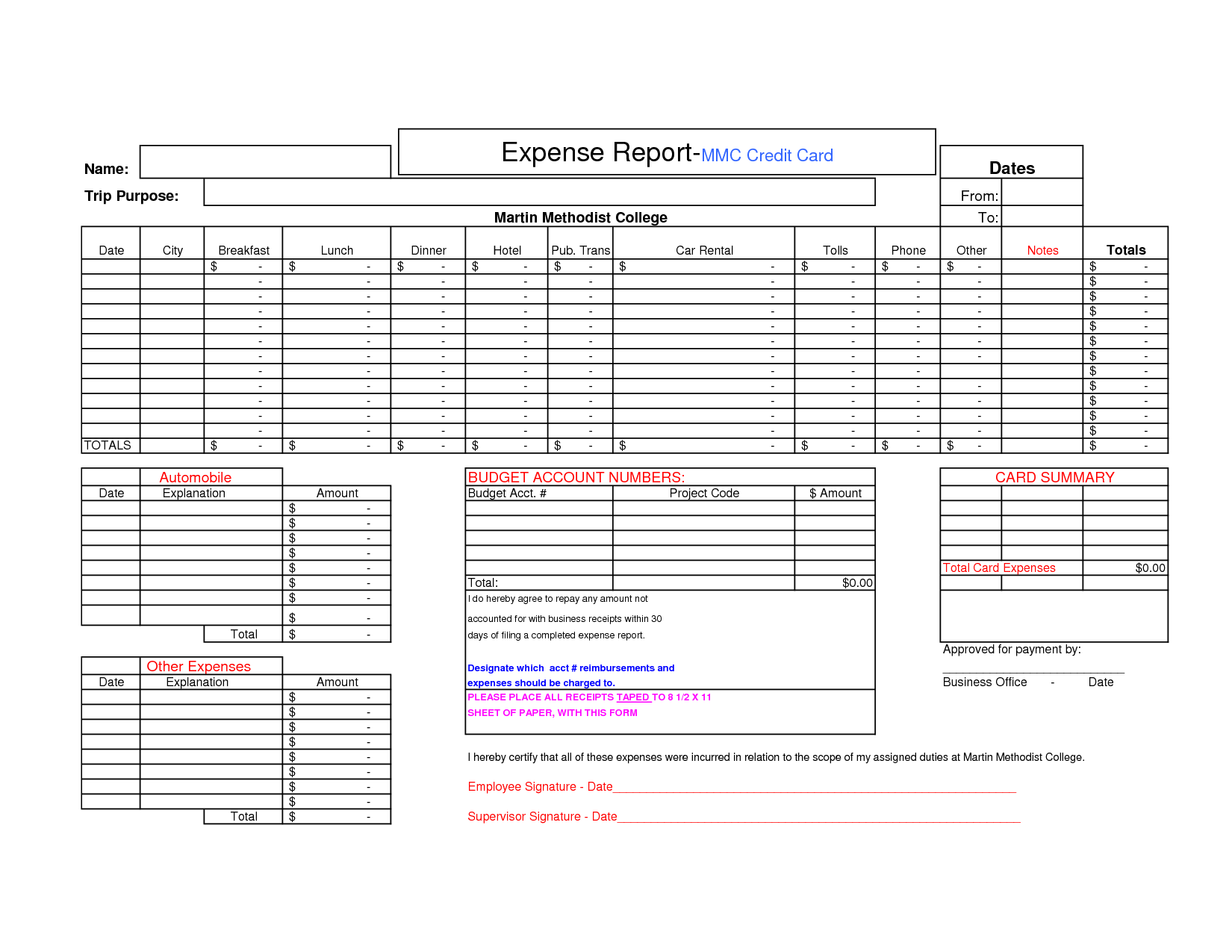

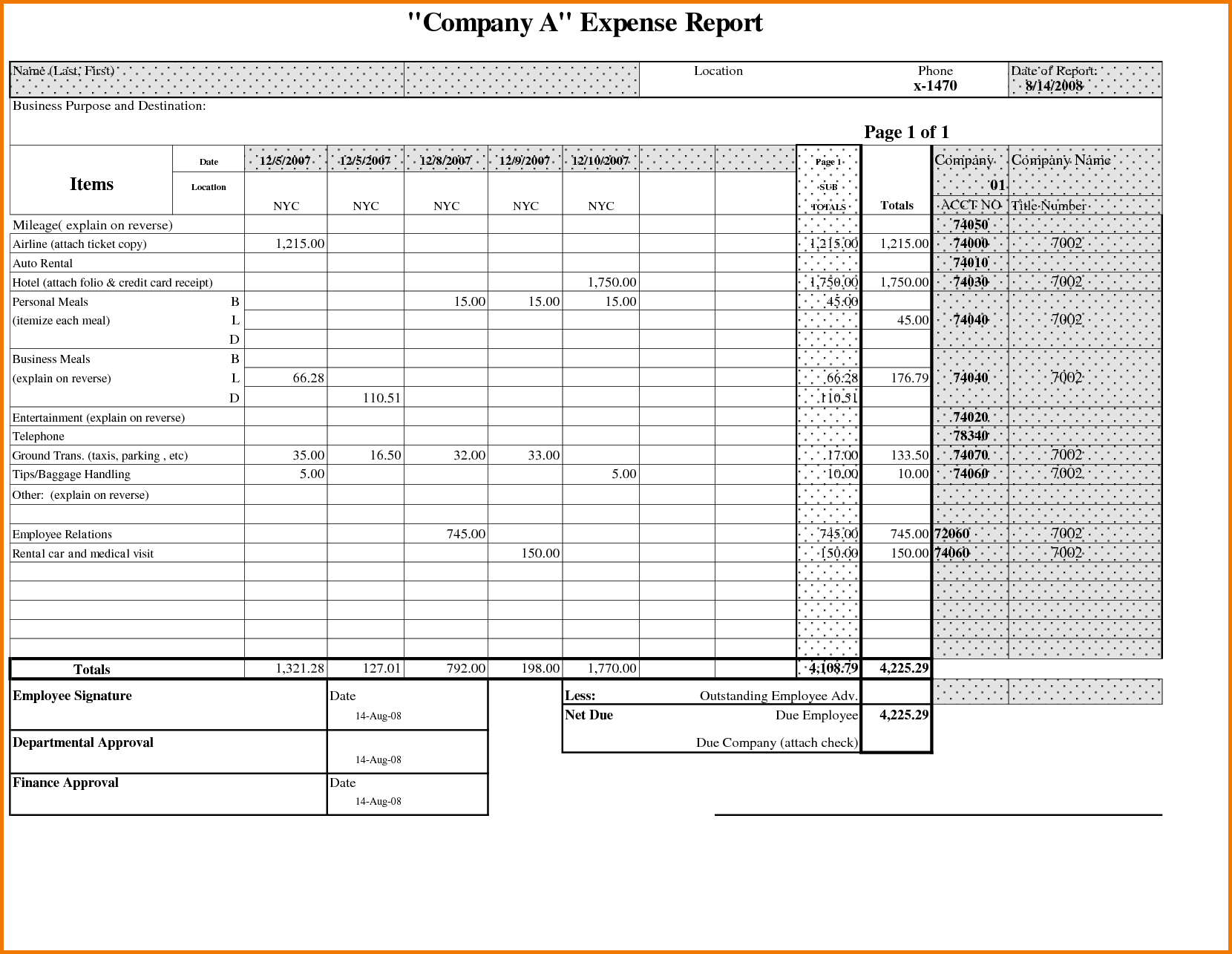

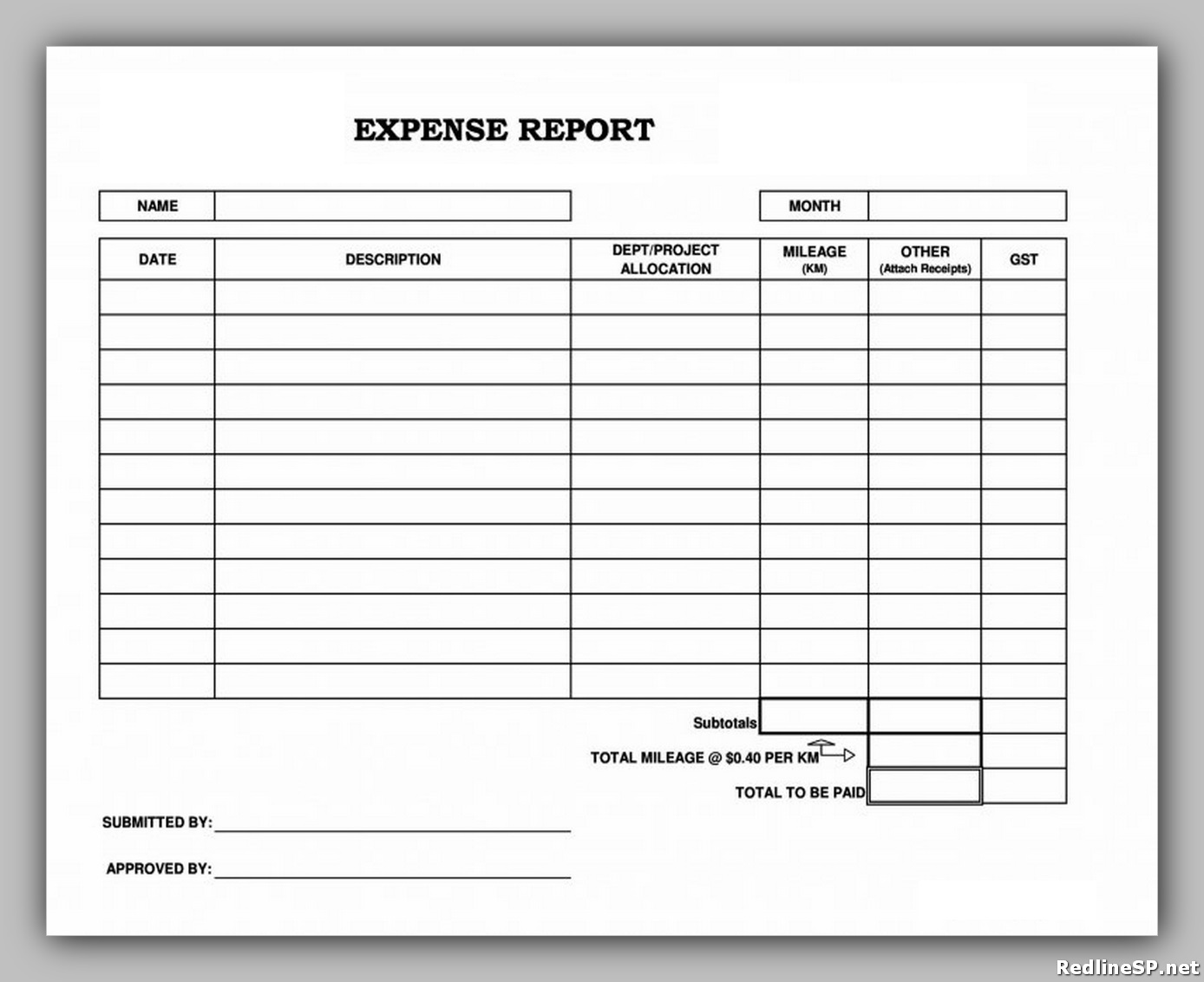

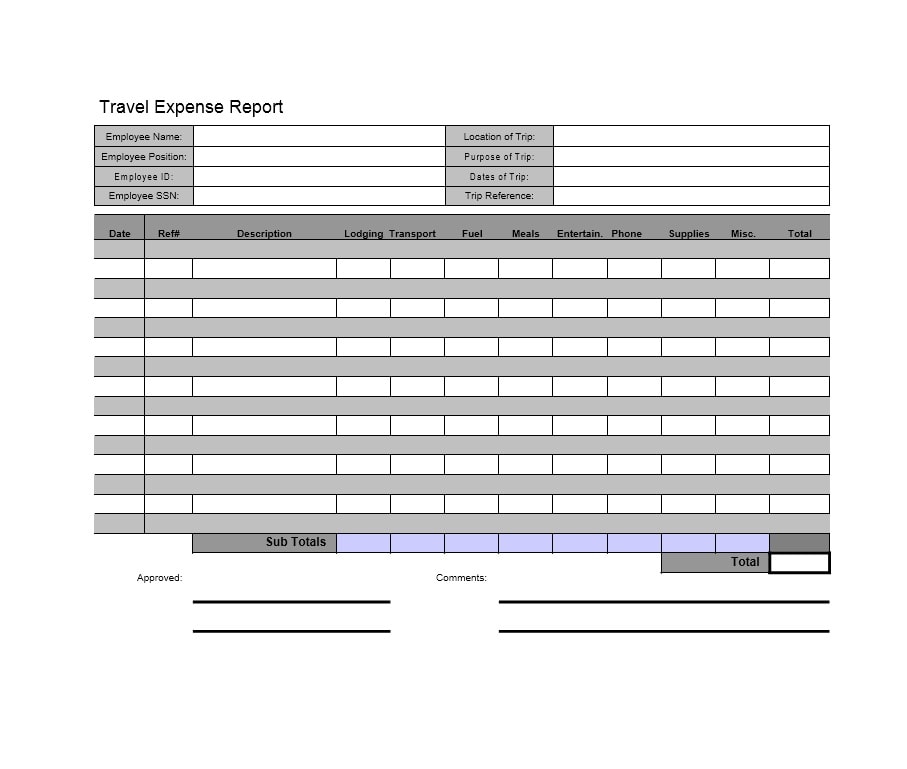

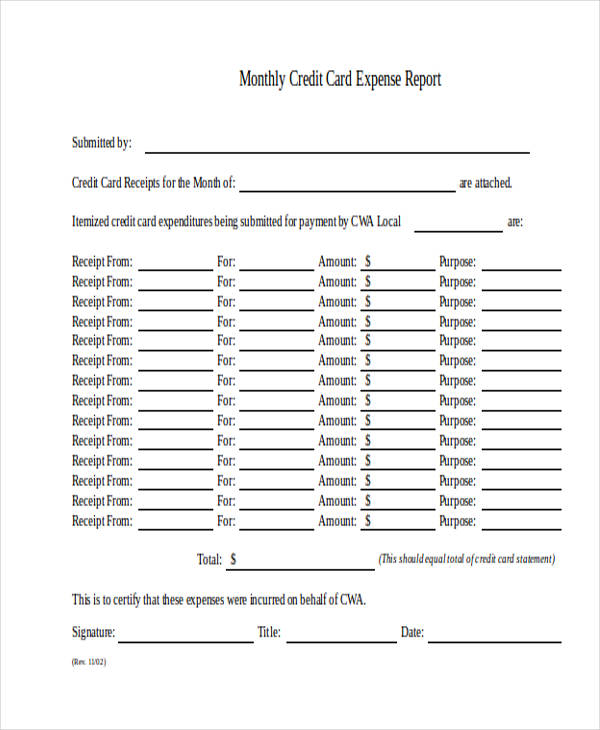

Credit card expense form. You can use your expense report form to track any type of expenses your business incurs. Once all of the information has been compiled into the business expense. Whoever uses a company credit card can use the free expense report template from freshbooks.

Analyze your spending: Confirm that the particular expense is allowed under this policy. Business credit cards are issued by banks in.

Complete either section a or section b, below. When you’re using the company credit card, you should: To complete, just fill out details on the blank sections provided.

This printable expense report should be accompanied by receipts for. The maximum amount of the. It’s printable, editable, and downloadable in excel.

This expense claim form is perfect for employees requesting reimbursement for any business expenses. The form is yours to do with as you need. Spend management what is a credit card expense report?

Template details file type: Contents 1 what is a credit card expense report template? Accurate expense reporting is a key part of financial compliance for companies.

This template summarizes credit card expenses to track business purpose and amount spent. This credit is now known as the clean vehicle credit. Extend lets you create unique virtual credit cards for complete control.

Mind the credit card limit and the transaction limit. But there is a floor. Finance teams need to record every expense incurred by the company, whether through.

Corporate credit card expense management is how organizations track expenses against budgets, process all supporting documentation, migrate transaction data to the erp to. 2 page (s) file size: Company credit cards help boost business finances but only with accurate expense reports.

The report typically provides the details of each expense, the. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). You can choose from more than 750.